Long-standing readers will be aware of my views on inflation – i.e. how the official data is a joke. Back when inflation was running at 2%-odd, I suggested baking in 7%. With the official rate now reaching that level I still don’t believe it! I’d say it’s safe to assume double-digits.

Wealth Leakage #3 of 3: Inflation

We previously discussed Wealth Leakages #1 and #2: Taxes and Fees. The chart below shows how how inflation eats away at your savings. I have only factored in the official rate here. With a more realistic 10%, the real value of £100k would be an unthinkable £34,868 after 10 years – a 65.1% devaluation!

What Can We do about it?

A lot, actually. In investing, you can often discover beneficiaries amongst uncertainty. We can invest in asset classes that tend to rise during inflationary episodes.

In a recent class inside our investment academy programme, I compared various asset classes to evaluate their performance during previous inflationary periods. Read about some of those ideas here in an article i wrote.

Equities – a beneficiary of inflation

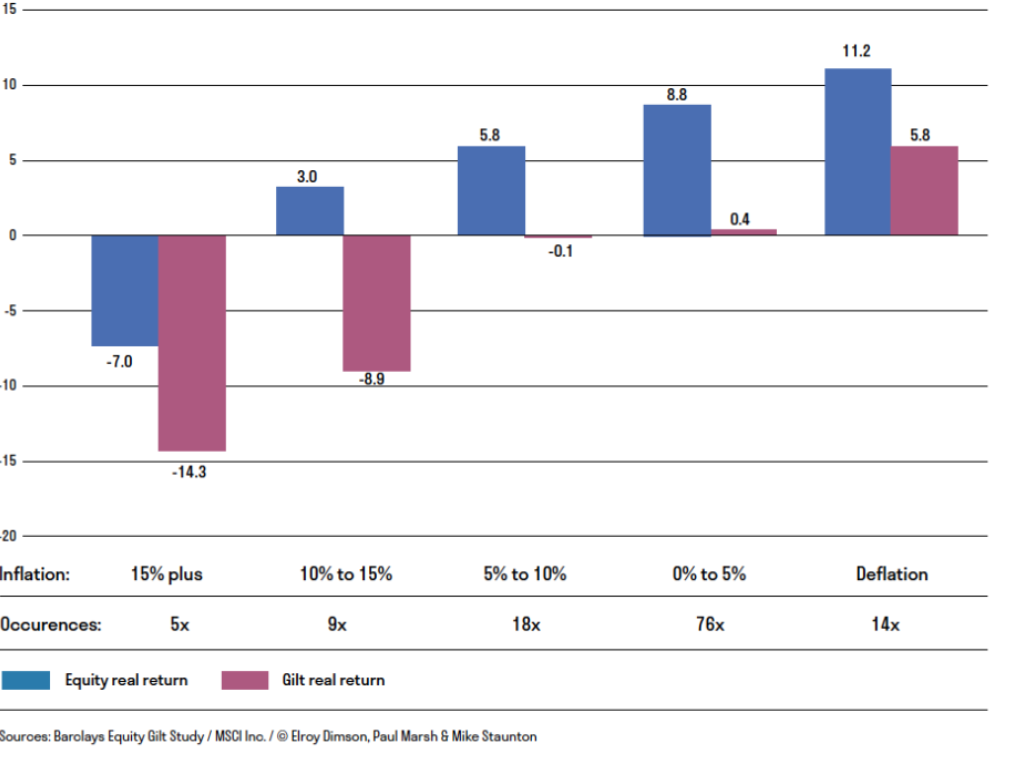

The chart below shows the real return of equities (nominal return minus inflation) during different historical inflationary periods, since 1900. As you can see equities produce positive real returns across all scenarios – except when inflation exceeds 15%. I know inflation is high but doubt the official number will reach 15% as the supply-related factors should subside.

Why do equities outperform during inflation? Company revenues and profits tend to grow in line with the reality rate of inflation. For many companies it’s even better because they have operational leverage where costs are fixed whilst revenues rise with inflation – resulting in a turbo-charging of profits. This goes a long way to explain why stockmarkets keep appreciating over time.

Many other inflation beneficiaries …

There are numerous other inflation beneficiaries covered inside the Investment Academy Programme.

You’ll learn a step-by-step, guided process (with support) to set up your own low-cost, passive, inflation-beating compounding portfolio. All under your own control where you don’t line the pockets of others!

Plus you’ll learn other strategies – such as earning regular income via Options and high dividend-yielding stocks. Plus, there’s a module on Crypto investing.

Now includes a bonus module on Due Diligence on Secured Loans: Selecting the right ones, identifying the red flags

The next programme begins soon. Further info here.

Format: Online Live classes (All classes recorded for catch-up if you miss any)