How do you feel about Investing at All Time Highs?

In a recent Investment Academy class, we showed how to invest in Gold and how owning it can protect your portfolio..

Gold sits in the Protect part of our passive portfolio. As a reminder, our easy-to-implement portfolio consists of G-P-I: Growth, Protect, and Income.

One person in class noted gold was currently at an all-time high. That may be true, but it should never be a reason to not invest.

Why? Because all-time highs are the rule, not the exception.

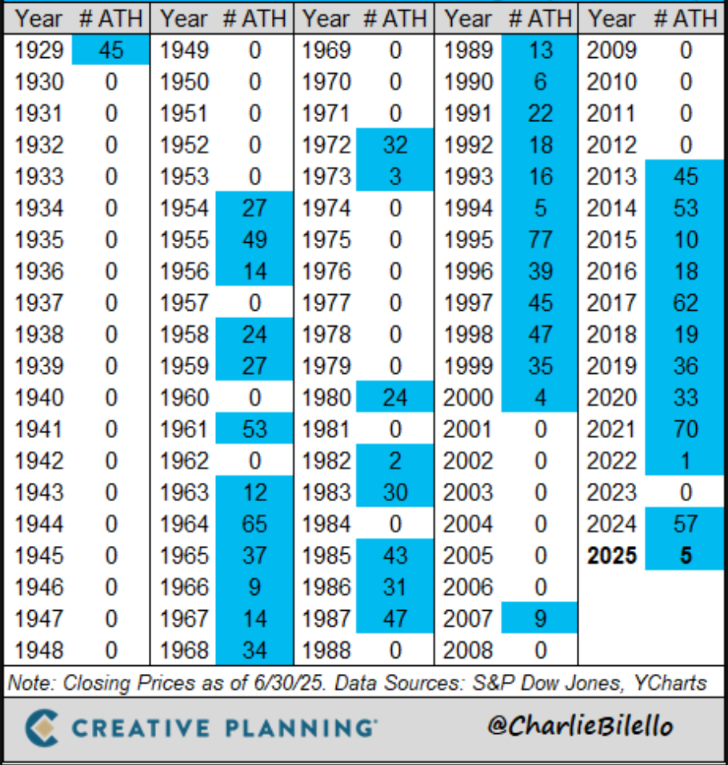

Interesting Stat: 2024 saw 57 all-time highs – see box below.

Btw: For more insights like this – straight to your inbox – leave your details in the box at top of this page ☝🏼

All-Time Highs are Normal…

This shows the number of times the stock market reached an all-time high – in every year – since 1929.

These stats are for the US stockmarket but apply globally.

Surprised? Think about it… We know markets gain by 8-12% per year, on average.

That means – by definition – they must keep reaching new highs.

So don’t be afraid of an all-time high. It’s just another headline-grabbing non-event that stops people from investing in their future.

On the other hand, our investors are trained with the right mindset to secure their financial future with our proven framework.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now