All bear markets have different causes. But they have one thing in common: a total and complete recovery – every single time. Before rebounding to even higher levels.

You don’t need to wait for a rebound before jumping in. Right now, my investors and I are earning income of between 5-20% pa with 3 simple strategies – described further below.

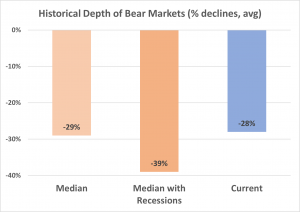

It’s not too often that equites have a major sell-off. US equities are down 28% this year.

For the US market this equates to a major bear market – big bears are rare! (Global markets, ex-US, are not doing as badly).

The previous bear was sparked by the Covid crisis. Back then equities dropped 22%, bottomed in March 2020, before climbing 70% over the following two years.

At the time, I wrote this to plant seeds about a possible market low.

The major bear market before Covid (the 2008-09 financial crisis) fell by more than 40% and went on to gain 600%+ in 12 years.

Bear markets are a necessity. They are required for the market to renew, evolve, grow and compound for long-term capital gains. It might feel painful during one (if you check your portfolio too often) but every bear market always delivers strong gains afterwards. Every single time.

Including the ups and downs, equities have generated returns of 8-10% per annum, on average, over the long term. Being in the game consistently is better than waiting in cash for the right time to join. Particularly when inflation is running well into double-digit levels.

Should I wait for this market to bottom?

There’s an ancient proverb that goes “he who tries to pick the bottom will get a smelly finger”. Ok, that’s not an ancient proverb, more a dad-joke in investment circles!

I believe we are a fair way into this bear market already. But when you can make solid income of 5-20% pa whilst waiting for the bottom, does the timing of a low even matter? Further below, I describe where I’m investing for that level of income ….

———————————————————————————————————————————-

Stop Press: the next Investment Academy starts November 22nd

Step-by-Step LIVE training to create your Diversified, Low-Cost, Inflation-Beating, Growth and Income Portfolio with ETFs and Options.

Popular with property investors seeking to diversify wealth with hassle-free growth and low-tax income. For SSAS, SIPP, ISA & Cash investors

Investment Academy – Pro-Grade Content includes:

Low-cost ETFs and funds – selecting using Pro-tools

Platform selection and DD for Pensions and ISAs

Options-investing to create a regular income stream

Pro-grade Company and Stock analysis

High-dividend stock selection – including REITs

Tax-efficient investing via SSAS, SIPPs, ISAs

Fee-efficient investing – save £,000s every single year

Due Diligence on Loan opportunities

Lifetime ongoing support in private Facebook group

Starts: Tues 22nd November – for 6 weeks

Format: Weekly online live classes at 6pm (All classes recorded for catch-up if you miss any)

Plus, structured online training in between live classes.

If you have any questions, book a quick call to learn if the programme is right for you.

—————————————————————————————————————————–

Analysis Continued: Earning great income whilst awaiting a rebound …

The truth is, nobody knows the precise date of the lows – certainly not the pros. In the meantime, one can earn solid income and/or PCA-into the markets.

When you start to pound-cost average (PCA) before the bottom it can actually prove to more effective than waiting to start right at the bottom. That sounds counter-intuitive but worked during the Covid crash – see the evidence here.

How long do bear markets last? Use history as your guide …

Every market is different but we can use historical observations as a guide.

Since 1929, the average bear market has extended for 12 months – with the average decline being -29%. The current bear market is 9 months old and has fallen by -28% (using the S&P500 index). See chart below. On this basis we are close to the norm already – in duration and decline.

Bear in mind that averages are just that. This one might be longer and deeper, we don’t know. What we can say is this bear market is now reasonably mature.

This could be a good time to at least start to prepare for that elusive bottom. At least by earning solid income whilst waiting for it. Worth considering if you are overweight cash being burnt by inflation.

Income Whilst Waiting

Here’s where i’m investing for solid income whilst awaiting a market recovery …

- Options (earning 1-3% per month in income)

- Dividend Stocks (5-8% pa on solid blue-chip companies)

- Solid REITs with dividends of 4-10% pa

(REITs = Real Estate Investment Trusts owning residential, commercial and care-related properties)

On our Investment Academy we cover how to invest in all the above.

Options

Options provide income potential of 1-3% per month and the opportunity to buy stocks below current valuations. Many of my students on the Investment Academy have been generating such returns even through recent market volatility.

As an options investor we can set our own preferred safety margin by choosing which stocks or ETFs to take an options position on. And we can choose how far below current market value to set the strike price. Unlike other asset classes, options allow the investor to set their own preferred trade-off position: a greater safety margin provides lower monthly income whilst a lower safety margin provides a higher monthly income.

High Dividend Stocks

Stocks yielding between 4-8% are within reach of the astute investor with solid, high-quality blue-chip companies with low debt and stable cash-flows. Not to mention the capital gain potential when markets are back on the rise.

These high dividend stocks can be screened using free online tools such as Barchart or Finviz. Investors should not only screen for high yields but also overlay “quality” filters such as solid balance sheets, low debt and stability of earnings.

REITs (Real Estate Investment Trusts)

I have just written a more detailed piece on REITs in this month’s Property Investor News magazine so obtain this month’s copy to learn more about REITs.

REITs are a blend between property and shares. They are a passive way to own property assets as traded shares. Different REITs specialise focused sectors such as office, retail, industrial, storage, care homes, infrastructure and residential.

REITs have sold off this year in expectation of a deteriorating property market which will be impacted because of its sensitivity to the cost of debt. As a group, REITs have sold off between 10-40% this year and they now trade at big discounts to NAV. This could provide big opportunities to investors to take advantage of effectively below-market-value opportunities.

There are also some relatively recession-proof REITs out there – eg focused on care homes – yielding 6-7% pa.

For more aha-moments like this – plus many others – join our forthcoming investment academy

Limited Places – Secure Your Place Now

FAQs on the Investment Academy …

– I’ll be away for some of the course – will classes be recorded for catch-up?

Every live class and module is recorded and can be accessed anytime for easy catch-up.

– Can my SSAS pay for the training? (Or Ltd Company)

Yes. Many attendees in our previous programme had the cost paid for by their SSAS. The easiest thing is to initially pay using your own credit card and then provide a Recharge Invoice to your SSAS administrator who can arrange for the SSAS to reimburse you (we will provide you a Recharge Invoice template). Alternatively, many attendees have paid via their Ltd company.

– After completing the programme what ongoing support is there?

We have a private Facebook group for past and present attendees only. This is an active group where you can ask for guidance on any of the training elements or other investment related issues.

– Is there other content apart from financial markets?

We have an entire module on property-related loans and P2P platforms — how to select safer opportunities by using our due diligence framework and avoiding the red flags (more info in the email copied below)

– Can I ask questions before booking?

Yes of course. If you have any questions, book a quick call to learn if the programme is right for you.

** Your Capital is at Risk ** This is not investment advice.

Investment Academy Programme – Further Details

Starts: Tues 22nd November – for 6 weeks

Format: Weekly online live classes at 6pm (All classes recorded for catch-up if you miss any)

What you’ll learn on the Investment Academy:

How to correctly invest in: Shares, ETFs, Funds, Options … passively and with low complexity and maintenance

How to minimise fees in low-cost ETFs

How to select the best, cost-efficient platforms

My Option Strategy and process used for passive income

Selecting higher dividend-yielding stocks

How to shelter your gains and dividends via tax-efficient wrappers such as ISAs, SIPPs and SSAS

The inside track on how the pros generate returns and, more importantly, what they never do

Investors come away fully equipped with professional-grade tools and techniques to identify shares and ETFs with the best returns v risk

New Bonus Module: Due Diligence on Secured Loans – Selecting SECURE deals, identifying red flags

Learn strategies that benefit from incredible compounding to secure your long-term financial future

Discover ways to protect your portfolio from inflation – and beat it

Live demos on finding the right ETFs, Funds, Shares and Options

Understand how to identify and minimise hidden fees in funds and platforms

You’ll come away a confident investor without ever needing a financial advisor – hence saving yourself £ thousands in unnecessary fees

The programme provides all the knowledge and tools you’ll need for a lifetime of successful investing – exactly replicating the strategies used by Manish himself

The full programme is delivered by professional fund manager, Manish Kataria

Full live support for your strategy throughout the programme

Access to private Facebook group with ongoing support

Limited Places – Secure Your Place Now

If you have any questions, book a quick call to learn if the programme is right for you.