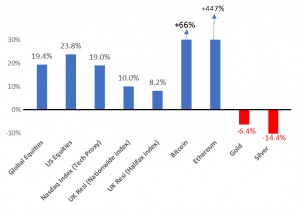

2021 proved to be some year, with strong returns across popular asset classes. Very few people would have expected these kind of returns, particularly after a reasonably strong 2020 too …

The risk warning: past performance should not be relied upon to indicate future performance remains as valid as ever. Indeed, it might well be the case that we pause for breath in 2022. But two factors remain valid for investing into “risk assets” via patient Pound-Cost-Averaging:

- Rising inflation is eroding cash at the fastest rate for 10 years – read my latest article here which lists investments that are inflation beneficiaries

- TINA. I wrote about this around a year ago and TINA continues to be a relevant reason to invest into “risk assets”

Below is a quick snapshot of each asset class I’ll be focusing on in 2022. Before diving in, ensure you:

- Stay Diversified

- Pound-Cost-Average your way in (PCA). With PCA you gain whether markets go up or down

Equities

- I can’t predict equity performance in 2022 but we know analysts expect company earnings to grow between 8-12% in 2022 (earnings expectations get revised over the year)

- TINA and Inflation will still be reasons to seek equity exposure

- Valuations are high (in some sectors) which could prompt volatility in 2022

- My equity strategy will focus on quality-factor ETFs and sector diversification

- In case of volatility PCA will be your friend, and an opportunity to buy at better prices

- Many attendees of my Investment Academy programme are successfully implementing PCA right now

Options

- I use Options to complement my long-term set-and-forget Equity investments

- Options generate regular monthly cash income

- If we see higher volatility in 2022 that creates an opportunity for even higher income (higher volatility = higher option premiums)

- A number of attendees in our Investment Academy have implemented their options strategy and already generating regular income from the strategies taught in the programme

UK Property

- There is persistent real demand for housing. The supply/demand imbalance will continue so don’t expect much change in these dynamics

- As long as interest rates stay reasonably low (this article analyses why i think rates will stay low), the overall picture remains supportive for residential and commercial property

Secured Loans

- Property fundamentals support the Secured Loans asset class

- In 2021 investors found it challenging to invest into quality Secured Loans in volume: Quality deal-flow has been in shortage

- A reminder to investors to stay selective when looking at loans – there are good and bad opportunities out there. As ever, you must do your own independent DD. As John Corey reminds us, platforms have no FCA-related requirement to conduct DD on the quality of loans. That’s not to say platforms (online or offline) are to be avoided (although some should be). Some offer very good opportunities but you need to be highly selective from one loan to the next

- Watch this space for new initiatives

Litigation Funding

- A new area i’m researching for 2022

- An “uncorrelated” asset class. Meaning it’s unaffected by any economic downturn, making it recession-proof

- Typical returns are 20%+ pa (IRR) with insurance-backed downside protection – with a holding period of 5 years

- Here’s the Wikipedia entry on it and another intro here

- I am currently exploring ways for investors to invest in a diversified portfolio of numerous litigation cases. Still early days but watch this space for more information and DD on the area

InvestLikeAPro looks forward to providing more passive investment commentary (and maybe one or two new offerings) in 2022.