When I was working amongst other investment professionals in my day job, I saw it clearly: women tend to generate better, more consistent returns.

So it’s unfortunate that women are under-represented in the investment industry.

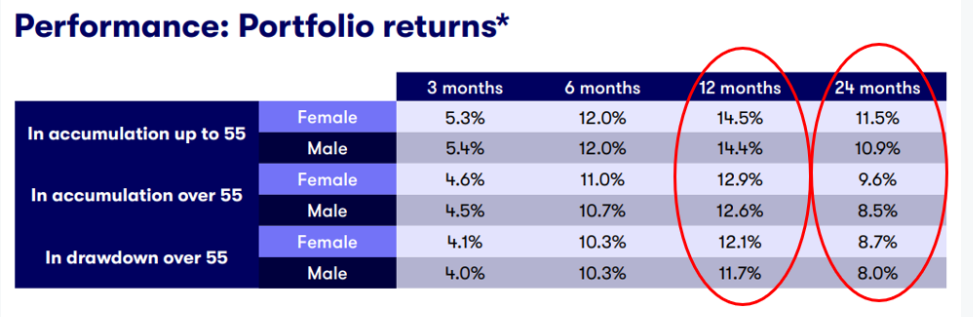

Female outperformance is evidenced in various studies and surveys. Below is a recent one by the investment platform Interactive Investor. This one shows returns from its own (non-professional) individual investors with an account …

Interactive Investor: Women v Men

A Loss for Everyone

The under-representation of females is not only sad for talented women who would make great investment managers. This is a problem for us all.

Why? Because the returns of professionally managed funds (which are male-dominated) consistently fails to match market returns.

Take a look at the evidence here

In other words, despite the stockmarket consistently providing inflation-beating returns (on a plate), professional managers – i.e. active funds – can’t seem to grab these returns.

In trying to OUT-perform, active funds end up UNDER-performing.

You can receive insights like this direct to your inbox – just leave your details here. You’ll also get my step-by-step investment guide.

How do women do better?

According to the Interactive Investor study, women invest more in diversified funds than individual stocks – i.e. buy the whole haystack rather than looking for the needle.

Women also tend to invest rather than trade. They are typically more diversified and avoid going all-in to the latest craze. They also have a longer-term outlook which helps.

These are all traits of successful investing – regardless of gender.

As i mentioned, numerous studies have shown female outperformance. Here’s one from Warwick Business School.

An Insider’s Perspective …

I will explore these traits in my next video and podcast, due to be released next week.

I’ll provide an insider’s perspective into how active funds work, their high (and hidden) fees, clever and questionable marketing and, of course, their returns.

Remember – our work pension schemes and IFA-managed funds are often full of active funds. Not only do they have high fees, their returns also lag passive funds.

This directly reduces our wealth and pensions. More will be revealed in my episode next week.

Until then, stay in diversified tracker funds to capture the power of inflation-beating passive returns from stocks.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now