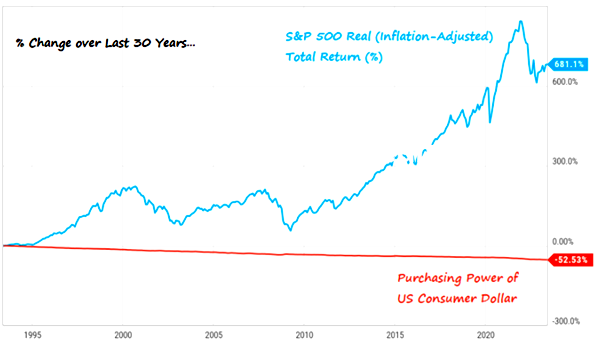

The chart below caught my eye this week. It summarises why you need to own REAL assets (defined below) …

It shows that over 30 years, the real value of cash declined by 52%, whilst the real value of stocks appreciated 681%.

The chart uses US data (US dollar and US stocks) but also looks similar in the UK – except the disparity is much worse due to higher UK inflation.

(Blue line = stockmarket returns; Red line = the decline of the REAL value of cash)

(chart credit: Charlie Bilello)

Two Key Lessons from this chart:

- Don’t hoard cash – it’s silently getting killed

- Own REAL assets

What are REAL assets?

Real assets have cashflow that grows with, or beats, inflation.

Companies (= Stocks) and Property both generate REAL cashflow (profits/dividends and rent) which have historically proven to beat inflation.

… which makes Stocks and Property REAL assets.

These might form your CORE portfolio. Have a good balance between the two.

Not only do they hedge you against inflation, they also COMPOUND consistently and massively over time (passively).

What are NOT real assets?

Apart from Cash … things like Crypto, FX, Trading, “Bots”, Gold and Silver have no cashflow and have not proven to beat inflation.

There’s nothing wrong with owning some Bitcoin, Gold etc (I do) for speculative / play trades – just be aware they may go through long periods of decline WITHOUT any cashflow/dividends (unlike stocks).

Which is why these assets should not be part of a CORE portfolio or pension as they are not consistent.

Contrary to popular opinion, Gold is not a reliable inflation hedge – it did nothing in 2021 nor 2022, when inflation started to accelerate towards 40-year highs.

How to build a Passive Core Portfolio?

Diversify, Pound-cost-average into index-tracking ETFs, ensuring low fees and taxes … and keep it passive: INVEST don’t TRADE.

We teach the exact steps on how to create a passive, set-and-forget, diversified, core portfolio. Watching over your shoulder as you set up your portfolio over 6 weeks. Learn more here or arrange a quick strategy call here for more info

Further Reading

To see how companies (=shares) BENEFIT from inflation, read my article here.

To learn about how the official inflation rate is under-reported, don’t just take my word for it – read about it here.

Ps: Thousands of people have learnt how to pound-cost-average into low-cost, diversified set-and-forget ETFs & Funds for inflation-beating growth. And Options for recurring income.

Click here to learn about our Investment Academy that starts in the new year – but you can Enrol Now to get learning IMMEDIATELY, in preparation for the January Start

Arrange a quick strategy call here for more info

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Think Long-term and beat inflation

- Minimise those leakages

- Passive beats Active

- Stay educated to outperform 99% of the population …

- Investing this way is the key to achieving passive financial freedom

Last but not least …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now

(Standard Text to go at end of every article …

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now