There are numerous inflation measures but only three to really care about. Spoiler alert: Investors need to worry most about #3 …

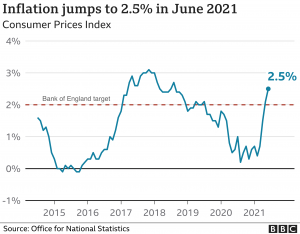

#1 The Official Rate – the one shown in the chart below – aka the “pretend rate”. It’s what the government tries to dupe us into believing. Don’t believe it – it’s unlikely to reflect YOUR true rate. It’s also backward-looking. The “current” rate of 2.5% (UK CPI) measures prices for a “basket” of goods and services in June 2021 vs 12mths prior. So not only is it irrelevant, it uses old data.

#2 The Central Bank Rate. This is more meaningful because it’s forward looking AND, more importantly, impacts on interest rates. Central Banks like the Bank of England look out into the next 12-24 months to see how inflation might evolve. The Bank of England currently expects inflation to rise towards 3% before moving down. Interestingly, the Bank’s outgoing chief Economist Andy Haldane, disagrees with the Bank’s official forecast and thinks the rate will peak higher at 4%.

Crucially, central banks around the world increasingly believe this spike to be transitory due to Covid related bottlenecks. As such, they appear relaxed about needing to materially raise rates.

#3 The REALITY rate for investors. As investors we should be most concerned about the TRUE measure of inflation. Which the government hides by the way. This is likely running at 7-8% pa, if not higher. For savers/investors we should be concerned about the purchasing power of our money in the FUTURE, right? That’s why we are saving – for future consumption.

So if you have cash sitting around, it is eroding faster than you think. In fact, the negative compounding of inflation means £100k will LOSE £31k over 5 years and be worth £52K LESS in 10 years.

Equities are a great beneficiary of inflation because companies see revenues, profits and cashflows grow in line with the REAL rate of inflation. For some companies it’s even better because they have operational and financial leverage where costs are fixed whilst revenues are free to reflect inflation, resulting in a turbo-charging of profits. This goes a long way to explain why stockmarkets keep appreciating. Exposure to equities protects your wealth against inflationary erosion. Over the long term, markets always keep up with #3.

Investment Academy – for more of this …

If you like the idea of setting up a diversified, set-and-forget compounding portfolio using a simple 3-step process, learn more here and see how others did it.

It includes an easy step-by-step process to get you investing into low-cost ETFs and funds that match your personal comfort levels and risk profile. All with full support to get you started at your pace – free of complexity.

The last programme was full and I expect the next one will be too.

A Blueprint for Investors – simple step-by-step training to invest in the markets and passively compound your wealth

Popular with property investors needing to diversify their capital to earn inflation-beating returns. For SSAS, SIPP, ISA and cash investors.

Starts 6th September 2021. Private Live Zoom Classrooms.

Why you should Attend?

- Learn a step-by-step way to simply and passively invest your cash in the markets

- We cover low-risk, balanced and adventurous portfolios – to suit your own risk profile

- Learn strategies that benefit from incredible compounding to secure your long-term future

- Discover ways to protect your portfolio from inflation – and beat it

- Live demos on opening accounts at platforms and finding the right ETFs, funds and shares

- Professional-grade techniques to identify shares and ETFs with the best the returns v risk

- You’ll understand how to identify and minimise hidden fees

- You’ll come away a confident investor without ever needing a financial advisor – hence saving yourself £ thousands in unnecessary fees

- The programme provides all the knowledge and tools you’ll need for a lifetime of successful investing – exactly replicating the strategies used by Manish himself

- The full programme is delivered by professional fund manager, Manish Kataria