Dealing with Uncertainty & Volatility

Morgan Housel, author of the best-seller “The Psychology of Money” (a highly recommended read) described Volatility as “The price of admission: the prize inside is superior long-term returns. You have to pay the price to get the returns”. In other words, investing is inherently volatile – which is precisely why you earn the prize of superior returns.

The original version of this article appeared in Property Investor News magazine.

For Now: Central Banks v The People

We don’t need official data to confirm the speed with which inflation has accelerated – we can all witness that first-hand with rising everyday costs. In turn, that has strengthened the resolve of central bankers around the world to push ahead with big rate hikes and withdrawal of monetary stimulus. This action is accompanied by an open acknowledgement of risking recession. Moreover, central banks are relying on a recession to control inflation.

It’s a difficult job being a central banker today: cynics will say they are about to sacrifice millions of ordinary jobs to protect their own. The central banker will say short-term pain is needed to prevent long-term economic disaster.

The net result: volatility across financial markets and new uncertainty in leveraged asset classes like property, which tends to follow (with a lag) other asset classes – especially when rates are rising.

Historically, during times of stress, government bonds and gold would be the obvious safe havens. We saw this during the global financial crisis in 2008 and the Coronavirus breakout in 2020. This time, the perfect storm of rising rates and high inflation have rendered bonds as somewhat of a basket case. At the same time, liquidity withdrawal has taken the shine off gold. Commodities have remained (until now) the only asset class posting strong returns.

Finally, although cash might seem to be a safe play, don’t forget that inflation is eroding the real value of cash, by somewhere between 10-20% pa right now. Sitting on cash for too long is not a viable option.

So how should investors position themselves in this environment? I list 5 ways below.

1. Make volatility your opportunity

Historically, macro shifts and the resulting volatility have ALWAYS led to fresh opportunities for investors – either by buying at lower prices or identifying emerging new trends. The opportunity to capitalise applies across asset classes – equities and property included. The historical average length of bear markets has been 11 months. Clearly that’s an average – some have been shorter and some longer.

The classic way to buy at lower prices is by pound-cost-averaging (PCA) which allows you to benefit from lower prices without needing to second-guess market direction and timing. PCA is particularly effective for liquid assets such as equities, but the same principle can apply to property too.

PCA is pretty easy to implement – one way is to split your investment pot into 10 instalments and drip-feed each one into the markets on a monthly basis. When equities are falling, PCA allows you to participate in the sales. When equities recover, it enables exposure to the upside.

2. Focus on Income over Capital gain

In periods of economic uncertainty income is more secure than projected capital gains, with the latter evaporating quickly if conditions deteriorate.

We know markets always recover before going on to make new highs – but we can never know the timing of an upturn. However, income-producing assets such as equities, property and options can generate good cashflow for the investor whilst waiting for capital gains to resume. Some of the aforementioned assets can yield highly attractive levels of income: high single-digit yields for selected equities and property is certainly achievable. For options, double-digit levels of income are within sight.

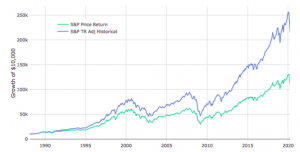

Whatever the market direction, Income can amount to a significant part of your total returns – particularly when that income is reinvested and compounded. That can be observed in the chart below showing historical returns of the S&P500 index – comparing the headline price move (not including dividends) with that of total returns with dividends reinvested (top line).

3. Return OF your capital over Return ON capital – Sharpen your DD

Some asset classes and opportunities – particularly those with higher leverage – are riskier during periods of stress. Leverage cuts both ways so investors should be extra vigilant when evaluating opportunities that seemed to perform well during previously good times. As Warren Buffett said, “when the tide goes out you know who was swimming naked”. Diversified equities and vanilla BTL property have always proven the ability to recover given the benefit of time. Lending on leveraged developments do not afford the luxury of time – that introduces risk if proper evaluation / DD has not been undertaken.

Margin of Safety

Any investment should be assessed by calculating its margin of safety. In other words, how comfortable is the buffer within the investment? Fortunately, much of the information needed to check this is within reach of the investor.

When buying a property, firstly ensure it has comfortable positive net cashflow. If it doesn’t, you are effectively taking a punt on future capital gains – that’s not a punt worth taking with rising rates.

Secondly, assess how the net cashflow would hold up if your mortgage rate was to rise to 6%, for example Also, know how many void months would result in the annual cashflow being wiped out. Ultimately, the higher the sustainable net yield, the greater is the safety margin.

For a loan to a developer, the quality of your security (first, second charge) and the quantity of it (LTVs) are both informative in assessing your safety margin. Avoid high LTVs. Have clean and clear exits. Ensure ample profitability – eg Profit/Costs.

For equities indicators such as dividend yields, P/E ratios, balance sheet strength, and earnings stability can all be evaluated using publicly available information. Again, it’s about sustainable earnings.

For options, the investor can set their own preferred safety margin by choosing how far below current market value to set the strike price. Unlike other asset classes, options allow the investor to set their own preferred trade-off position: a greater safety margin provides lower monthly income whilst a smaller safety margin provides a higher monthly income. Investors can choose their own preferred position on the income scale.

For assets that do not naturally generate income (gold, crypto) it’s difficult to calculate an intrinsic value and, consequently, knowing what the safety margin might be.

Don’t confuse Volatility with Permanent Loss

Investment risk can be explained in different ways. The classic measure of risk is volatility – in other words, how the price of an asset swings around. That’s how an IFA or wealth manager might define risk. Technically minded readers will recognise “standard deviation” as the statistical measurement of volatility.

On this measure we could say Crypto-currencies are more volatile than equities which, in turn, are more volatile than vanilla BTL property.

But it’s not always so clear-cut because some stocks or ETFs may have lower volatility than BTLs. And some sectors of property (eg leveraged developments) might have higher volatility than Crypto.

But volatility doesn’t equate to the ultimate safety of your capital. What should really matter to investors is the avoidance of a permanent loss of capital. If you’re investing for long-term compounded returns, short-term volatility should not matter – unless you plan to retire soon and will be reliant on a big chunk of your invested capital to live off.

More than a century of data demonstrates that investing in diversified equities or vanilla property has never resulted in a permanent loss of capital. Shares have witnessed strong inflation-beating compounded returns over the long-term, despite the numerous crises, recessions, wars and pandemics.

4. Be Diversified

All portfolios should have diversification at the core. Being diversified can protect investors from being over-reliant on a single asset class or a narrow geographical focus. It helps spread your risks.

As an investor you might have a large percentage of your wealth tied up in UK property. We are fortunate that UK property has been fairly stable to date, but the narrow focus exposes you to a single sector in a single country. For example, in recent years, we have seen increasing regulatory and tax changes in property. There are also non-monetary things to consider such as time commitment and the hassle-factor of managing property.

The advantage of globally diversified equities is as the label suggests: global and diversified. At a stroke, investors can mitigate a reliance on a single country and sector. Global equities are also fully passive, mitigating the time and hassle factor. As for returns, global equities have generated 8-10% pa on a long term average basis.

Global equities as a partial hedge against volatility

By investing in global equities, you also obtain exposure to global currencies. When you think about it, buying US shares makes you the owner of US-dollar assets. The currency exposure you end up having provides a hedge against volatility.

How? Sterling is a “risk-off” currency which means that during periods of stress, Sterling tends to depreciate. You can see that in the chart below. Sterling declined during the global financial crisis in 2008, after the Brexit referendum vote in 2016 and, again, during the current period of inflation and recession concerns (it also sold off sharply during the Covid crash of 2020).

Sterling vs US dollar …

When sterling depreciates that equates to an appreciation in foreign currencies vs the pound. In turn, that provides a boost to the value of our global equity holdings. Take the current period when the pound has declined from $1.35 to $1.15 between the start of 2022 to early July (the time of writing).

This depreciation has provided a boost in the value of foreign equity holdings by around 15%, serving to cushion the decline in equities. In other words, investing in global diversified assets acts as a volatility hedge for UK-based investors.

Other highly effective measures (less obvious but massively effective)

Asset prices appreciate and compound over time, we know that. However, Investors cannot control the direction and timing of the markets which will fluctuate in the short term, resulting in occasional volatility.

However, investors have complete control over other aspects of investing which have a significant impact on their long-term wealth.

5. Minimise Your FITs

Those other aspects within our control are what I call the FITs: Fees, Inflation and Taxes.

Fees

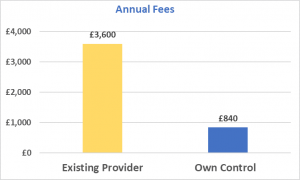

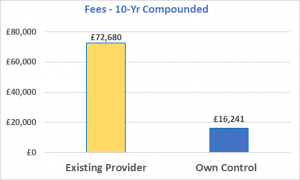

Over time, fees can potentially be significant enough to outweigh the impact of market returns. Most investors may not be aware of the impact fees have on their wealth – see chart below. Those who are aware of the impact may not realise the ease with which fees can be slashed. How? By taking control of your investments which is surprisingly straightforward to do. This fee reduction exercise applies to anyone with capital or pensions being managed by advisers or occupational pension schemes.

The chart below shows a real-life example of an attendee at our investment academy who very easily reduced their annual fees from £3,600 to £840 per annum. That translates into a 10-year compounded saving – from £72,680 to £16,241. Imagine the saving over a 25-year horizon.

Inflation

Minimising the impact of inflation can be achieved by taking on debt (being aware of rising cost of your debt), having awareness of the destructive effect of inflation on cash, and having exposure to inflation beneficiaries such as diversified commodities funds and infrastructure assets. Read about potential Inflation Beneficiaries in this previous article I wrote

Taxes

Taking advantage of tax allowances can provide a massive boost, irrespective of how markets are moving. Utilising your annual pension allowances and ISAs are easy wins to start with. Contributing to your pension in a tax-efficient manner can provide an immediate return on investment of up to 40%-45% – before even considering any investment returns.

Finally, don’t panic!

Uncertainty is a constant, always there – that’s why markets climb a “wall of worry”. Use this knowledge, with some of the above strategies, to position your portfolio and create an opportunity from uncertainty.

The above commentary applies across all asset classes.

These are the personal views of the author whose risk profile and investment objectives may differ to yours. As such, none of the above should be taken as investment advice for you personally.

Capital at Risk.

Investments may not be covered by the FSCS.