The Rule of 100 is widely used by IFAs or Wealth Managers (WM) as a way to invest your money.

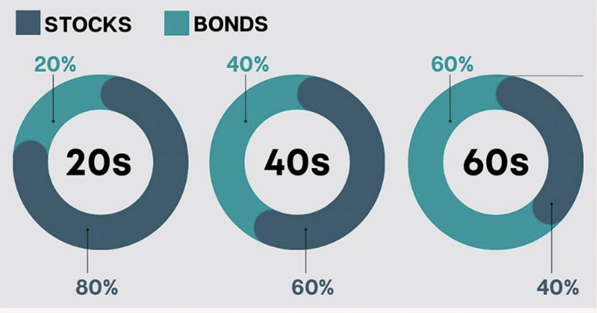

As illustrated in the graphic below, it goes like this …

- Subtract your age from 100

- That gives the % of your portfolio to have in Stocks (shares)

- The remaining % in Bonds

For a 40-year old, that means an asset allocation of 60% in Stocks and 40% in Bonds. For a 60 year-old, 40% in Stocks and 60% in Bonds.

The logic is, as you get older, you should own a greater % of your assets in “less volatile” fixed-income assets like bonds.

But this widely-used rule failed in 2022 when bonds declined sharply as inflation and interest rates rose.

In my view the Rule of 100 is too simplistic and somewhat lazy – for something so important.

But it’s convenient for IFAs and WMs to invest your money in this way – for 3 reasons:

1.Stocks and Bonds fall into regulated advice territory – meaning that IFAs and WMs can systematically charge for their services around Stocks and Bonds – in a way they can’t for other assets. This creates a potential bias.

2.IFAs and WMs may not be knowledgeable about – or even aware of – other more effective asset classes (listed below)

3.The Rule of 100 is easy to pigeon-hole investors into. Once set-up, there’s not much ongoing management required. That enables your IFA/WM to passively earn significant fees from your wealth – see my article for a fright!

The Rule of 100 has been widely followed by the financial-advice industry for decades. It made sense in the 70s-90s when bond yields were consistently high and other asset classes were not widely available.

But things are different today.

The world has moved on …

Historically, if you wanted a properly diversified portfolio you needed an IFA or WM. And, by default, accept the Rule of 100.

Today, we don’t need an IFA nor the Rule of 100 for a diversified portfolio. Thereby, we can avoid the high fees.

Now, anyone can set up a diversified, set-and-forget portfolio with ETFs and Funds which are automatically rebalanced and diversified.

IFA-managed funds may hang onto the Rule of 100, but we can be smarter with asset classes that are more effective, more suitable and cost-effective.

Is your portfolio fit for purpose ?

When people attend the Investment Academy they can have their managed funds or pension schemes evaluated in detail.

I see portfolios all the time that are totally unsuitable for the client, along with poor performance. Yet, they pay away very high fees.

Discovering this often saves people £000s annually, not to mention the vastly improved returns.

The Reality of Bonds and More Effective Asset Classes …

The Rule of 100 states you should always own some bonds (unless you’re a newborn).

Below are 7 reasons one may not always wish to. Some IFAs or WMs might not understand these – or not be incentivised to incorporate them into your portfolio …

1.Bond Yields. Bond yields are not as attractive as they were in the 70s-90s. Today, a 10-year UK government bond yields 3.8% pa. Bonds may not fulfil your income requirements as they used to. Other assets can provide better income (see below).

2.Other asset classes. You might already have bond-proxies in your wider portfolio. Eg a significant % in Cash or Residential Property or Secured Loans. These assets provide stability of asset values and/or income. So, does your managed portfolio actually need bonds?

3.Inflation. Bonds are a nominal asset which means their yields don’t keep up with inflation – unlike stocks which are proven to benefit from inflation. Profits, dividends, and share prices keep up with inflation.

4.High income Shares. You can own high-dividend shares and ETFs that provide income levels of 4-8% pa which is higher than bond yields

5.Options. Options can be an effective asset class for recurring monthly income – typically 1-3% per month. Some options strategies can even be used as an insurance hedge to protect your shares during periods of volatility.

6.Money Market Funds. Today, MM funds have much better yields than bonds. With no capital fluctuation and instant access, MM funds might be preferable to bonds for many investors.

7.Personal Risk Profile. I often see managed portfolios or pensions that are disconnected to their owner’s risk profile and/or end objectives.

One example of #7 being someone with a higher-risk profile or having significant other assets including cash. They might find their work pension having a significant allocation to Bonds (hence underweight Stocks) which might be inappropriate for their profile.

Finally, it’s worth noting why people may be advised to have a proportion in bonds. The common view is that bonds are “less risky” than equities. The problem with this view is that advisers may sometimes conflate the ideas of risk and volatility – read here for more on that.

Are there any reasons to own bonds? Perhaps …

Government bonds might serve as an “insurance hedge” when the economy is going into recession. That’s because interest rates will decline and bond yields will fall. As yields fall, bond values rise – hence providing a hedge against your shares which might decline due to recession concerns.

So – if you’re concerned about a recession or need dependable fixed income, bonds might be a consideration for you.

Also, if one has short-term liquidity needs, bonds may be more dependable than shares in the short-medium term (Money Market funds would be an even better choice)

In Summary

Evaluate your portfolios – including your work pensions and any managed portfolios.

When I help people evaluate those pensions and managed portfolios, I find more than 90% underperform AND charge high fees for doing so.

Don’t hesitate to question why you’re paying significant fees for something that’s inappropriate … and easy to self-manage.

IFAs and WMs – some balance!

To be clear, I believe financial advisers can be useful for more complex planning and tax purposes.

Managing your own investments is very do-able on an ongoing basis but the initial set-up may be more involved – particularly if you have specific planning, tax, and lifestyle needs which an IFA or WM can help with.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now