In 2023 the Magnificent 7 stocks have been on fire. So far, their returns this year are …

Microsoft +58%, Amazon +71%,

Why so strong?

More than 6 months ago I flagged a Tech-sector revival in a Mastermind meet for our Investment Academy attendees.

I highlighted 4 factors likely to support the outperformance of tech in 2023. Those factors being:

- Ai growth

- Decent earnings prospects

- Reasonable valuations

- Decline in bond yields

These have since materialised, driving the Magnificent 7 up.

Narrow Leadership ? …

The bears remain unhappy! They see the US market being too dominated by a narrow group of tech companies. To be fair, they have a point.

The Magnificent 7 totals 25%+ of the S&P500 index (the US equivalent of the FTSE100). The bears don’t like this concentration and flag this as a concern.

In 2023 the overall S&P 500 has returned 19%. Excluding the Magnificent 7, it would “only” be +7%.

Admittedly, I would also prefer the market to rise broadly vs narrowly.

But is it such a concern?

The argument used by the bears assumes a narrow leadership is unusual.

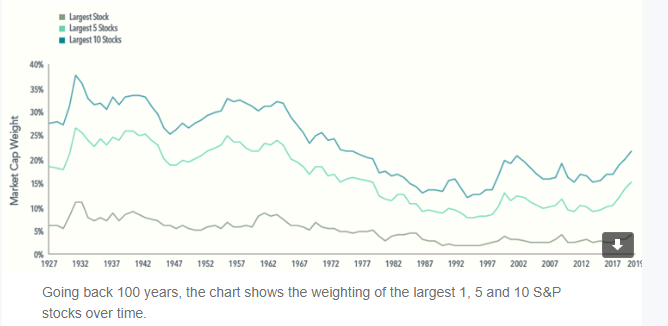

However, according to investment company Dimensional Fund Advisors, such concentration is historically normal. Take a look at their chart below

Going back 100 years, the chart shows the weighting of the largest 1, 5 and 10 S&P stocks over time.

On this basis, the weighting of the largest stocks today is consistent with the long term trend – suggesting limited cause for concern.

There’s ALWAYS a big theme …

Big Tech / Ai is the thing now. But looking back, there was always a big, but narrow, driver of the overall market.

In the 2000s the dominant theme was commodities and China plays.

In the 90s it was the dot com sector.

In the 80s it was all about Japan.

In the 70s Oil and Gold ruled.

The 60s had the “Nifty Fifty” stocks

The 50s saw the reconstruction of Europe.

All of which makes sense – the stockmarket reflects what’s important in the global economy at any point in time.

What’s now interesting is that tech and Ai has the potential to transform entire economies, create new efficiencies and boost the earnings of all sectors, not just tech.

So why not just buy the Magnificent 7 ? …

This is where the power of ETFs (and index funds) comes in.

With individual companies, although they look invincible one day, they won’t continue to dominate forever.

Think about Nokia, Kodak, MySpace, Blackberry, Yahoo etc etc.

Google will some day lose its dominance in Search. Nvidia will certainly face new competitors in years to come. And the cult following of Apple will one day worship something else!

ETFs … no need to find the needle

The beauty of ETFs is they always (by definition) own the winners whatever the dominant theme of the day is.

That’s how they work: ETFs have to hold the winners and sell the losers. (Active funds and traders often sell winners too soon and hold onto losers too long).

As John Bogle, the founder of Vanguard, said:

“Don’t look for the needle, just buy the haystack”

i.e. buy an ETF or index fund holding the whole market.

That’s why we shouldn’t stress about the Magnificent 7.

Far better to sit back, own the haystack and let the dominant companies of the day work for your financial freedom.

Remember, after all, the ultimate objective of listed companies is to maximise shareholder returns.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now