Today I reveal something that will forever transform the way you think about stockmarkets!

This will probably blow your mind …

150 years of data reveals that markets have NEVER permanently lost money – always bouncing back to make new gains, whatever has happened.

Key idea: Volatility has NEVER meant permanent loss – it was always your opportunity

Getting this was a massive a-ha moment which has proved to be a huge lightbulb moment..

Something that allows me to be financially independent – with my capital working for me so i don’t have to.

Importantly, it shows the value of something we focus on closely inside the investment academy – namely, Pound-Cost-Averaging.

The evidence behind that aha moment …

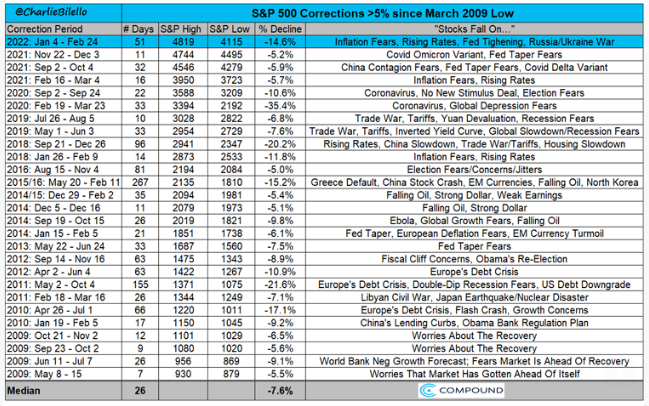

The table below shows all the uncertainties that caused a market correction of >5% in the US (S&P500 index, 2009-22).

We saw recession concerns, wars, pandemics, interest rate fears, worries about inflation, debt crises … you name it, we had it!

Doesn’t this list look worrying?

Well, let’s view those same events on a chart to put things into perspective. All those “losses” are shown as red dots in the chart below.

During the whole period, the market rose by 615% (or 16% pa), including dividends.

For the patient investor, those were highly profitable “loss-making” uncertainties ..

As Warren Buffett says, “The stockmarket is a device that transfers wealth from the impatient to the patient”

My key message: Don’t panic, stay diversified. That helps you buy when stocks are on sale.

Over the long term, stocks have returned 8-10% pa (using data going back to 1871).

That makes stocks a passive, wealth compounding machine.

Time IN the markets beats TIMING the markets. Invest, don’t Trade

How to work this to your advantage?

A simple process called “Pound Cost Averaging” (PCA) that helps you buy more when stocks are on sale. In the Investment Academy we teach you the step-by-step process to properly set up PCA to suit your own risk profile.

In the Investment Academy we show case-studies to see how well PCA works. This includes during one of the biggest market corrections, the Covid crash. You’ll be surprised to see how a crash like that can be highly profitable by employing PCA – click here to see the results.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now