Plus: something that blew my mind this week …

Stocks have been running strong for a while; this structural bull market started in 2009.

Interspersed by shorter bear markets in between (2018, 2022) – all of which subsequently recovered with fresh new highs.

All along, crash predictions were rife – encouraging many people to hide in cash. That meant missing out on stocks – which have since doubled every 6 years.

Popular warnings over the last few years included:

- The Global Economy is Too Weak

- Actually, real GDP has doubled since 2007

- The Stockmarket is Fuelled by QE

- We’ve seen Quant Tightening since early 2022 (= less money supply)

- Global Conflicts eg Russia, Ukraine, Middle East are bad for stocks

- Historically, markets react minimally to conflicts

- High Inflation & Interest Rates will stay high and kill the market

- Valuations are Too High

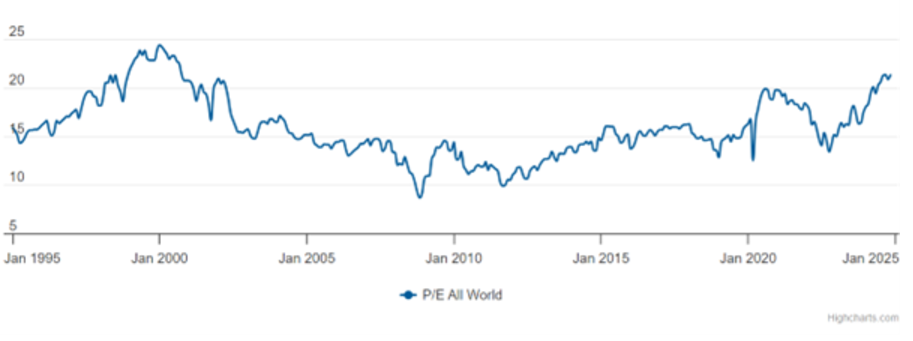

- This one is interesting. At 21x we can argue the global P/E ratio is not cheap (equally, not excessive) – see chart below ..

Btw: For more insights like this – straight to your inbox – leave your details in the box at top of this page ☝🏼

Global P/E Ratio since 1995 …

Are we missing something more important?

Valuations are subjective – different people can use the same metric to reach different conclusions.

Sometimes, the denominator (expected Earnings) can be manipulated to suit the argument.

But even if we all agree valuations are not cheap, are we missing something BIG, happening right before our eyes?

The pace of technology and Ai is accelerating so fast, it’s hard to see it in real-time. Already, Ai is creating huge real-world benefits for society, for companies, productivity and profits.

That potential is not being captured in current P/E valuations.

In fact, the bulls could easily argue that current valuations are too low. Worth considering.

So THIS blew my mind …

Talking of Ai’s potential, here’s a personal experience that stunned me this week.

Remember my email from last week? Well, following a tip from one of our Investment Academy grads, I decided to have some fun with it on a text-to-voice Ai app …

What resulted blew my mind: have a listen here

Try it yourself. Enter any text (eg one of your emails, an article, or even just a brief story about your day). Then wait for it to do its magic!

When something like this is possible, what else is?

Do current valuations really reflect what will be possible in the future?

Finally – our latest Investor Circle Meet: Crypto Investing

We held our latest Investor Circle meeting this week. This is a fortnightly mastermind for grads of the Investment Academy where we share our investment experiences.

We’re lucky to have a great community of knowledgeable Investment Academy grads in our group. All with experience and knowledge across different asset classes. Definitely a case of 1+1 = 3.

A big thanks to the members for sharing some quality Crypto content to the group this week. Hugely eye-opening.

NEW for 2025 – Crypto Training Included …

Our brand new Investment Academy in January now includes Live Crypto Training to guide you how to invest safely and manage the risks …

Managing the Risks

If you’re going to invest in Crypto, make sure to do it properly. That means:

- Understand the historical volatility

- Manage your portfolio risks using a Core + Satellite approach

- Know about the platform risks

- Be aware of the security aspects of owning it

- Some coins will grow sustainably. But know that some are just honeytraps

Like the rest of the Investment Academy, our aim is always to help you create a properly diversified portfolio with sustainable returns.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now