| When investing, if all you do is get average returns (historical stockmarket average is 8-10% pa) and avoid common mistakes, your portfolio will compound very handsomely over the long term.

If you try to shoot the lights out with every investment you make, you’ll also have a lot of blow-outs.

Average x Compounded = Spectacular over the long term

My experienced boss and mentor Steve taught me that in finance and investing (just like with other industries) it’s often the marketing that makes the sale rather than the quality of the investment itself.

This applies across asset classes including stocks, funds, development loans or property (estate agent tactics!).

My boss Steve often reminded me of the old adage …

If it sounds to good to be true, it often is

Avoid expensive Funds

One example in the investment space: consider the existence and success of “active” fund managers (you’ll recognise them by their adverts on billboards, magazines etc).

Active fund managers aim to beat the market on a consistent basis – as opposed to “passive” managers (such as ETFs) which aim to only match, or track the market on a consistent basis.

As you might expect, active funds charge investors a high fee for their ambitious plans whereas passive tracker funds or ETFs charge low fees.

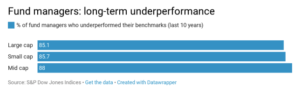

Now, look at the evidence below showing how 85% of active fund managers underperform the market – i.e. they underperform passive funds and ETFs (which delivered positive, inflation-beating returns) …

Despite this under-performance, active fund managers still thrive and attract investors – and charge premium fees!

How? … Great marketing is how!

The key message: if you differentiate between style and substance you’ll make the best returns, most consistently, and with reduced risk.

For more about underperforming funds, take a look at this graphic measuring the consistent underperformance of active fund managers.

A few simple rules …

- If it sounds to good to be true, it often is. Be mildly sceptical

- Fund and wealth managers are primarily accountable to their shareholders vs those who buy their services (hence the high fees)

- Think about the marketing messages being used. Certain words and images are tried-and-tested marketing tactics designed to make us buy (or invest)

This applies to any asset class including stocks, funds, property-related investments or pensions.

In the investment academy, you’ll learn exactly how to filter out marketing bias and avoid many other common mistakes that people make all the time.

All content in the academy draws upon my own professional knowledge, experience and learnings along the way.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now |