One word explains the difference: RETURNS

Trading

With trading, your success rate is 50% at best. Basically, a coin toss. Sometimes you win, sometimes you lose.

Don’t just take my word for it. In the UK, by law, every trading platform has to display a “wealth warning” on top of its homepage. Take a look at an example below …

Investing

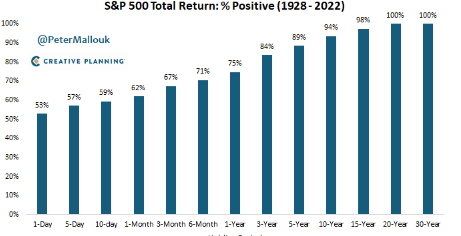

With investing your success rate is 100%. That’s right, investing in stocks has NEVER resulted in a permanent loss – see chart below. Diversified equities – low-cost ETFs or Funds – ALWAYS fully recover and make new highs – as UK stocks are doing right now.

On top of all that, you receive dividend income. All income and gains are tax-free when investing via ISAs and Pensions … no need to file those dreaded tax returns! All totally passive and hassle-free.

So, ensure to INVEST rather than TRADE

The REAL reason is LONG TERM returns. Global equities have returned 8.1% per annum, on average, over the long term.

Don’t try to time the markets. Be diversified. PCA-in. Have a low-cost set-up … Let compounding do the rest.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now