Gold is on a good run, reaching record highs* at the time of writing.

In this article I’ll bust some myths about gold, review what’s driving this rally, consider whether we should own it now, and show the best way to invest.

Historically, I haven’t been a gold bug (a superfan of gold) for the simple reason that it does not pay income. But keep reading for reasons to consider owning it now …

You can watch a video version of this article here on YouTube

Zero income means Gold can do nothing for decades …

Because gold has no income, the price of it can afford not to rise over long periods of time, sometimes even decades.

As shown in the chart below, gold just went sideways between 1980-2005: a quarter century of zero gains – i.e. a significant decline in real terms, adjusting for inflation.

Between 2010-20, it went down, then sideways again for 10 years.

And again, sideways between 2021-23 – even with inflation accelerating.

(*also remember that stocks are at or near record highs)

Wait … isn’t gold supposed to be an inflation hedge?

No. That’s a myth. Look at the evidence …

Between 1980-2005, inflation averaged 3.2% pa. Compounded over 25 years, the total inflation over that period amounted to nearly 50%.

Yet gold did nothing in those 25 years. Moreover, the chart below shows the inflation-adjusted price collapsing and never recovering back to the early-80s peak.

More recently, between 2021-23, inflation accelerated to a 40-year high of 11%. Guess what gold did: nothing!

The current rally in gold started in March 2024, just as inflation declined to 3-year lows!

So it’s always important to be led by evidence (not myths and headlines). And the evidence fails to support the inflation-hedge theory.

After adjusting for inflation, Gold is down since the early 80s …

To directly receive insights like this, and for a step-by-step investment guide, just click here.

Why shares HAVE to keep rising …

In contrast to gold, shares generate profits & dividends which have always grown over time. Thereby, forcing share prices to follow.

Quick Example: let’s say the share price of a company is £20, its earnings are £2 per share and it pays dividends of £1 per share. So it has an earnings yield of 10% (= P/E ratio of 10) and a dividend yield of 5%.

Profits grow due to growth and inflation (see chart below) so the share price cannot afford to stand still. Otherwise, if profits reached say £10 per share and dividends rose to £5, a static share price would mean an earnings yield of 50% and a dividend yield of 25%. Then, the shares would be hugely undervalued and get pushed up by incoming investors.

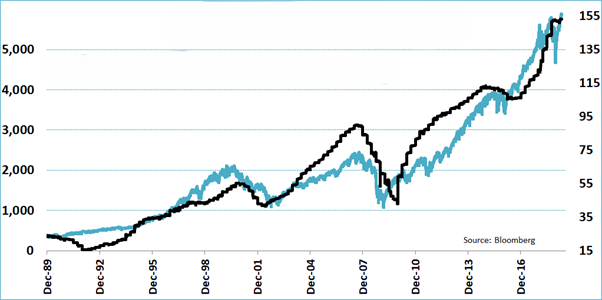

Hence, share prices must grow in line with profits and dividend growth. And they always have – see chart below.

Shares have always risen – because profits have …

(Black line: profits; Green line: Stockmarket. Data from the US. Source: Bloomberg)

Watch a video version of this article on YouTube

Listen to a podcast version of this article on your preferred Podcast Platform

However, because gold has zero income if its price did not rise over long periods of time, it wouldn’t really matter because it cannot become undervalued. An asset can only be valued if it generates income.

When does gold appreciate?

1. Fear

Gold is a ‘fear trade’. When there’s economic stress or fear around the world, gold benefits from a “flight to safety”.

Look at the gold rallies in the first chart. 2007-11: Global Financial Crisis & QE. 2020: Covid Pandemic.

2. Geopolitical Conflicts and concerns

Another case of ‘flight to safety’. With conflicts in the Middle East and Eastern Europe, some investors may fear escalation and hide in gold.

3. Interest rates & bond yields

Because gold has zero income, it tends to perform when interest rates and bond yields are declining. Why? Because the opportunity cost of owning gold reduces when rates are falling. We saw this in 2007-11 and in 2020.

4. China and the US Dollar?

Some analysts say the current strength in gold is down to China seeking to offload its US dollar reserves in favour of gold. This could be happening to an extent but remember, China holds $3.4 trillion in US reserves. Offloading this mountain of dollars would take decades and could also backfire on China.

Finally, if China was selling dollars, that should cause a decline in the US dollar. Currently, the dollar has been appreciating.

What’s behind the current strength?

Since March 2024, gold has appreciated. Partly due to some of the factors above.

But gold is somewhat of a black (or yellow!) box. It’s never easy to know what’s driving it at any point.

We can assume it’s a combination of all of the above.

Should you own gold in your portfolio?

I see gold as an insurance hedge. Gold works when ‘bad things’ happen such as economic stress, global conflicts etc.

So it could be a diversifier amongst an existing portfolio of shares, property and other such assets.

If you need a hedge for potential global stress, gold may be worth considering as an ‘insurance asset’. (I have a very small amount in my own portfolio).

How to invest in gold …

Gold can be owned in your personal name, your Ltd Company, in ISAs and in a pension. It can be bought in various forms:

- Physical Gold. You can buy coins or gold bars. Be aware that you may need storage vaults and that costs money.

- ETFs. In my opinion, the best way to own gold. Gold ETFs are easy, low-cost, and can be owned in tax-free wrappers such as ISAs and pensions. There are many ETFS available – one London listed example is from iShares (ticker: SGLN)

- Options. You can do gold ETFs through Options with the added benefit of earning monthly premium income.

- Shares in Gold mining companies. Gold miners benefit from a rise in gold via higher profits. Gold mining companies include Newmont Mining, Barrick Gold, Anglogold Ashanti etc. There is even an ETF that owns different gold miners. Take care to do extra DD when buying individual companies.

- You can learn the exact steps on each of these in our Investment Academy

In Summary …

Gold is not an inflation-hedge. Nor does it produce income. Gold can do well but can equally go through long periods of moving sideways or even decline.

When it doesn’t perform, we can think of buying gold like paying a premium for some insurance.

Gold works well during periods of global stress – economically and politically. This is the most useful reason to consider owning gold – particularly if you like the idea of having insurance to protect your portfolio during turbulent times.

Get more investment insights like this …

To directly receive more like this, and for a step-by-step investment guide, just click here.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Think Long-term and beat inflation

- Minimise those leakages

- Passive beats Active

- Stay educated to outperform 99% of the population …

- Investing this way is the key to achieving passive financial freedom

Last but not least …

– The above is NOT an investment recommendation

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now

Finally …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.