THE COST OF FEES – it’s Devastating

In this article, we cover Leakage #2 – Investment Fees. Plugging this hole is fairly easy and will have a HUGE beneficial impact for you and your family …

Don’t keep paying away your wealth to others.

Fund your own retirement, not theirs.

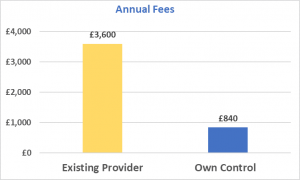

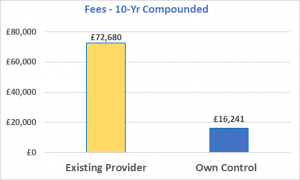

Look at the Difference – when you bring things under your own control …

Below is a real example with an average person slashing fees from £3,600 to £840 – that’s only per annum! (first chart). It equates to saving £56,438 when compounded over 10 years (second chart) … that’s £56k of your own wealth given away to someone who is likely to do a very poor job – see here for the evidence of that

Assuming Capital size of £240k, growth of 8%pa with fees compounded at same rate. The bigger your capital, the bigger your fee saving. On a £400k pot, your 10-yr saving could be £96k

If you have pension scheme(s) or other funds being managed by a provider or wealth manager, the chances are you’re being over-charged fees. You can drastically reduce the fees you’re paying. Even the “average fee” is way too high and can be cut by 80%.

How to Cut Fees – £2,760 pa in this case …

I’ll use the real example of John – a recent attendee on our Investment Academy Programme. John joined the programme to set up a low-maintenance portfolio that would compound over time in a low-cost way. He did this within 4 weeks of joining and genuinely couldn’t believe how simple it was to do so, using our 5-step guided process.

John had existing pensions worth around £240,000 – managed by a provider charging 1% pa, plus management charges (TER) for the funds in which the pension was invested. So a total of 1.5% pa. In £ terms, those fees equated to £3,600 per annum. Over 10 years, that compounded to £72,680 [luckily, John was not leaking even higher fees of 2.4% that certain un-named wealth managers commonly charge – not to mention their lock-ins 🙁 ].

Fee Saving and Better Performance Track Record

On the academy we took John through a low-cost passive set-up consistent with his own risk profile and liquidity needs. Surprisingly, his old provider had not taken account of such considerations. Plus, this set-up had a much better performance track record than John’s existing scheme.

What were the fees for John’s new (better-performing) portfolio?

0.25% management plus £240 pa for the platform. In summary, for doing the same job (arguably better, actually) John’s fees are now lower by £2,760pa – now just £840 per annum – compounding to £16,241 over 10 years.

The new improved set-up meant that John now keeps 94% of his gains over 10 years – compared to 72% under the previous arrangement.

John gets to keep his growth for his own security, not for his pension provider or wealth manager.

How you can save £2,760 pa or £56k over 10 years

The Investment Academy Programme could pay for itself in less than one year. You’ll learn how to easily make these savings – and much more if you capital is higher than £240k. Not to mention better returns and other strategies.

You’ll learn a step-by-step, guided process (with support) to set up your own low-cost, passive, inflation-beating compounding portfolio. All under your own control where you don’t line the pockets of others!

Plus you’ll learn other strategies – such as earning regular income via Options and high dividend-yielding stocks. Plus, there’s a module on Crypto investing.

** Your Capital is at Risk ** This is not investment advice.

What you’ll learn on the Investment Academy

- How to correctly invest in: Shares, ETFs, Funds, Options … passively and with low complexity and maintenance

- How to minimise fees in low-cost ETFs

- How to select the best, cost-efficient platforms

- My Option Strategy and process used for passive income

- Selecting higher dividend-yielding stocks

- How to shelter your gains and dividends via tax-efficient wrappers such as ISAs, SIPPs and SSAS

- The inside track on how the pros generate returns and, more importantly, what they never do

- Investors come away fully equipped with professional-grade tools and techniques to identify shares and ETFs with the best returns v risk

- Learn strategies that benefit from incredible compounding to secure your long-term financial future

- Discover ways to protect your portfolio from inflation – and beat it

- Live demos on finding the right ETFs, Funds, Shares and Options

- Understand how to identify and minimise hidden fees in funds and platforms

- You’ll come away a confident investor without ever needing a financial advisor – hence saving yourself £ thousands in unnecessary fees

- The programme provides all the knowledge and tools you’ll need for a lifetime of successful investing – exactly replicating the strategies used by Manish himself

- The full programme is delivered by professional fund manager, Manish Kataria

- Full live support for your strategy throughout the programme

Can my SSAS pay for the training?

Yes. Many attendees in our previous programme had the cost paid for by their SSAS. The easiest thing is to initially pay using your own credit card and then provide a Recharge Invoice to your SSAS administrator who can arrange for the SSAS to reimburse you (we will provide you a Recharge Invoice template).