September 2021. This week, we began our latest Investment Academy with an initial session around diversification of asset classes, compounding your returns and how to beat the inflation monster, amongst other things.

During the Q&A session we had a lively discussion around equity valuations … which I thought would be useful to articulate further here.

If you’re worried about equity valuations as a reason NOT to invest, I hope this provides some balance. At the end of this article, I share a couple of simple tips on how to keep investing – EVEN if you remain cautious.

Equity Valuations

On most measures, equities don’t look cheap – that’s for sure. A frequently used measure is the Price-Earnings ratio, or the P/E, which takes the share price of a company divided by its expected earnings (profits). The US is the largest stockmarket so let’s use that as a representation for equity valuations. The first chart shows the P/E for the S&P500 index (think: the US version of the FTSE100). As you can see, the current level of 21.2x doesn’t LOOK cheap … (source: Yardeni Research).

Is P/E the correct measure to use?

The problem with using a valuation measure like the P/E is that it doesn’t tell the whole story. One of the reasons equities have KEPT rising, and can KEEP rising, is that interest rates are ultra-low. Historically, interest rates have averaged 5-6%. Today they are near zero. Interest rates MUST be accounted for because they are FUNDAMENTAL to the economy, company profits and equity performance – read my article on “TINA” which covers this.

So a P/E of 21.2x in today’s world of easy policy and low rates has a very different meaning to a similar P/E when policy was tight and rates were high … i.e. you can’t compare the two.

A more relevant measure …

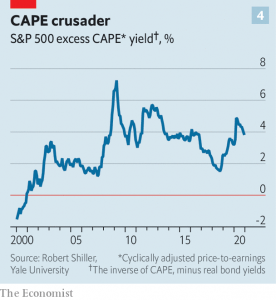

A valuation measure incorporating interest rates is far more relevant given how the world has changed. A measure that combines the P/E and interest rates is the Excess CAPE Ratio, as shown in the chart below. You can read more about the Excess Cape Ratio here

This shows the Excess CAPE Ratio over time – revealing equity valuations to be pretty reasonable on this measure …

Although i remain positive on markets, I would welcome a sell-off as that would be healthy AND provide an opportunity to buy cheaper.

What makes investing fascinating is the existence of many different views and measures. But, ultimately, it’s the market that decides what’s right. Over time, the market has indeed been a trustworthy indicator of the true value of companies and equities.

What if you have capital sitting around but remain cautious?

1. Pound-Cost Averaging

Here, you win both ways. If markets keep going up, you make money on the amount invested. In a sell-off, you’re also happy as you get to buy at lower prices.

This means drip-feeding your capital into the markets over time. You choose the time period and the frequency (monthly, quarterly etc) but do it on a regular basis according to the original schedule you set.

2. Invest in a Balanced ETF or Fund

Instead of making a binary decision – that is to either go all-in equities or stay in cash – cautious investors can go for a balanced strategy consisting of, say, 40% equities and 60% bonds. The bond element provides protection in case of a sell-off but still earns better than cash … you will know my views on inflation and holding too much cash – read my previous article around inflation here

For more of this …

If you like the idea of setting up a diversified, set-and-forget compounding portfolio using a simple 3-step process, learn more here and see how others did it.