Sales don’t come around too often – unless of course you shop at DFS or Sports Direct!

Stocks tend to gain value 70-80% of the time and decline for the rest. Overall, and on average, they return 8-12% pa.

So stockmarket sales are always an opportunity to grab bargains – but a regret when the sales run out.

Take any significant historical correction: Covid (2020), the Global Financial Crisis (2008), 9/11 (2001) etc. You’d look back and kick yourself for not taking the opportunity.

But when we employ Pound-Cost-Averaging, that means never missing the bargains.

Seasonal sales about to start?

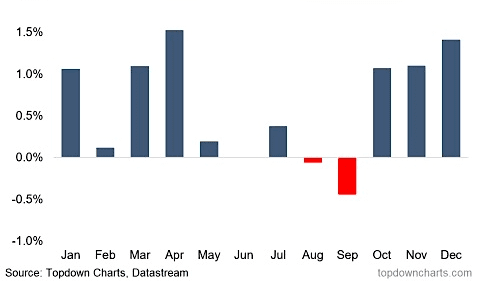

August and September have historically been great months to pick up bargains – see the chart below …

Average monthly returns in stocks since 1964 (US Market)

As shown in the chart, markets tend to be seasonal. Analysts don’t fully know why, but let’s take that as a given.

August and September have tended to be negative, in an average year. Making those months great buying opportunities ahead of the historically strong Q4 afterwards.

How do I feel about sell-offs?

I always look forward to them!

Particularly this year in the absence of a decent correction for some time. The market has gained by 8-10% already in 2024.

So if the US economy softens and the market doesn’t like it, I’d take that as an opportunity because it will prompt the US Federal Reserve to push through rate cuts.

In the meantime, being a consistent accumulator of shares, my excess cashflows (from rents and other income) are patiently pound-cost-averaging into globally diversified ETFs *

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now