Options can be a rich source of income – Warren Buffett is a big fan. And options can be a safer way of investing in stocks or ETFs that you like anyway.

In this explainer I’ll dive into a popular Options strategy known as “The Wheel”. You can think of it like a property rental business.

With options we rent out stocks instead of property, for monthly income. This explainer will walk you through the process step by step, ensuring even beginners can get a grip on the strategy.

Understanding Options: The Basics

Let’s start with the basics—what is an option? An investor that owns an option would have control over the related asset (property or stocks) without having to own the asset. The cost of the option (aka the premium) is usually a fraction of the cost of the asset.

The seller of this option earns the premium – which is the income we receive from options.

If you own shares in a blue-chip company or an ETF, you can ‘rent’ out your shares by selling options on them. On the other side there are investors who will pay you 1-3% per month to ‘rent’ your shares – i.e. to obtain control of them without needing to own them. This uses Call Options.

Btw: For more insights like this – straight to your inbox – leave your details in the box at top of this page ☝🏼

The Mechanics of Call Options

Here’s how it works. You purchase shares, let’s say for a £100 a share. You then sell a 1-month call option for £1.50 a share. That lets the buyer of the options ‘rent’ your shares for 1 month, earning you the premium income — 1.5% per month in our scenario.

Have you heard of a rent-to-own agreement in property?

Call options work similarly; the renter (option buyer) has the right to buy the shares at a pre-agreed price (Strike Price) at a future date (1 month).

Suppose your strike price is set at £105. If the share price doesn’t reach this target, you keep the shares and the option premium and rinse and repeat for a further month, earning another month’s income.

If the price does reach or exceed £105, you must sell the shares at this price. You still pocket the premium plus benefit from any capital gain.

Owning shares and selling call options is together known as a covered call strategy, a popular way options investors earn income.

Introducing Put Options

What happens when you’ve sold your shares at £105 and then need new assets to earn income from? Enter put options ..

They work like an underwriter at an auction; you set your target (strike) price at which you’d be happy to own the shares you like anyway, eg £102.

If shares fall to this level you get to buy something you’d be happy to own, at your target price (£102).

If they remain above the target, you earn the premium income and move on to the next month to repeat the process.

Whatever the scenario, you’ll be paid the premium income anyway.

The Options Wheel Strategy

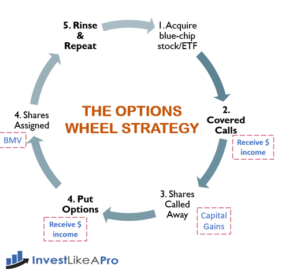

When you combine call and put options, you create what’s known as the Options Wheel Strategy. This is a conservative, repeatable cycle: acquire shares, rent them out with call options, lose them, acquire more with put options, and continue the cycle.

This is a safer way to own shares versus directly buying shares in the usual way …

A Practical Demo with Interactive Brokers

We conducted a live demo on Interactive Brokers, our Options platform. Let’s use the Nasdaq Index, a diversified Technology ETF (QQQ) which we already own. This demo was done live in our video – click here to view it.

We focus on one-month options to maintain monthly income flow. The ETF trades at $475.

Next we find a suitable call option, willing to sell shares at a slightly higher price—for instance, $480 (our strike price). This call option earns $14.20 per option, which equates to a 3% monthly premium. Using a paper trading account (an excellent tool for learning without risk), you’ll quickly learn the ropes.

Exploring Other Assets

This strategy isn’t just for traditional stocks but also for Crypto or Commodities like Silver or Gold.

➡️ I have written a more detailed step-by-step guide, including top tips and worked examples of Options trades. Get your copy here.

Concluding Thoughts

The options wheel strategy is a well-rounded method to generate monthly income with controlled risk. While individual stocks bring greater returns with higher volatility, starting with ETFs offers more safety and diversification.

Each investor’s journey is unique; they can adjust their wheel based on their own financial goals and risk appetite.

I hope you found this guide insightful. Whether you’re new to options or looking to refine your strategy, understanding this approach can potentially enhance your investment portfolio.

What this means for you …

An effective passive portfolio consists of both Growth (ETFs, Stocks, Funds) and Income (Options, Dividends, REITs).

When Growth and Income combine, it makes for a powerful combination to balance and grow your portfolio.

Implementing your Options strategy is a key part of our Investment Academy – learn more here.

➡️ If you’d like a more detailed step-by-step guide, including top tips and worked examples of Options trades, Get my Options Explainer here.