December 14, 2025

Your Portfolio on Autopilot – with Evidence …

Written by a human (me), not Ai.

The investment world is full of opinions and predictions. Making them is easy: just sound credible and hope to be right. Unfortunately, most predictions are wrong!

Which is why my investing is based on evidence, not predictions (see our returns below).

Our GPI portfolio (Growth + Protection + Income) does what is proven to work. Not because I’m some guru! But because I have based it on historical evidence.

Btw: For more insights like this – straight to your inbox – leave your details in the box at top of this page ☝🏼

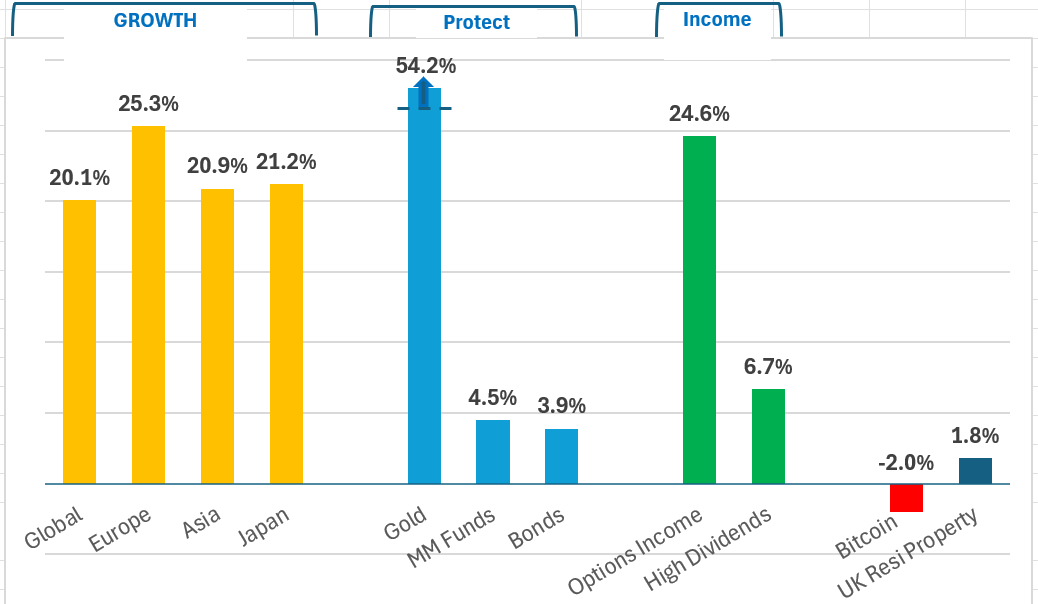

Here’s how we performed in 2025 [Bitcoin & Property is not in GPI but shown for reference] ..

- The Orange bars represent our Growth investments. Global is our Core, Set-and-Forget ‘Autopilot’ ETF. Europe, Asia and Japan are optional ‘Satellites’ we highlighted inside our investor community.

- The Blue bars are our Protect assets. They let you sleep better at night. These usually do well if growth assets are under pressure.

- The Green bars are our Income generators. They provide an income stream that is usually more reliable than capital growth.

- Options can be safer way to invest vs buying stocks in the usual way

- The Options return shown is the income-only component and excludes any capital growth (some of our options strategies provide growth and income).

- High dividend stocks give high dividends and the potential of capital growth. All with quality blue-chip stocks.

- Takeaway: Options + Dividends give you recurring cashflow while the Growth pillar compounds. And protect stays resilient.

GPI: A passive, diversified portfolio – on Autopilot …

The chart shows 2025 returns. But this is no 1-year wonder! Stocks are one of the best long-term wealth creation tools ever invented …

In the last 10 years global stocks have returned 12% pa, on average. That equates to a doubling of your capital every 6 years. That’s proven, inflation-beating wealth creation.

No need to make predictions, closely monitor or day-trade. And no chasing headlines.

The best part: GPI is a copy & paste system that is literally set-and-forget (especially the Growth and Protect components).

GPI is a passive, low-cost portfolio doing what it was meant to do: compound wealth reliably, and largely on autopilot.

Get a GPI Portfolio in 2026 – now with DOUBLE Options Content …

In January we launch the most improved version of the Investment Academy since it began.

The updated version includes:

- Double Options Module: with expanded Options-income training and support

- Step-by-step guidance so you can implement without guesswork

- A premium, hands-on experience with personalised private 1-1 coaching

Enter 2026 with clarity, confidence, and a portfolio that actually works.

Lock in 2025 Prices – before they RISE in Jan …

We start live classes in January but people have already joined for actionable investment content to make a head start now

Join Now For Accelerated and Personalised guidance to create your portfolio in the correct way – LIVE with me and our coaches making sure you’re doing it properly. Sign Up Now

Book a Call with me to ask any question

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now