Diversification is the initial building block I learnt in my first job in the investment industry.

Not only is it necessary for a properly set-up portfolio, it’s the holy grail of investing.

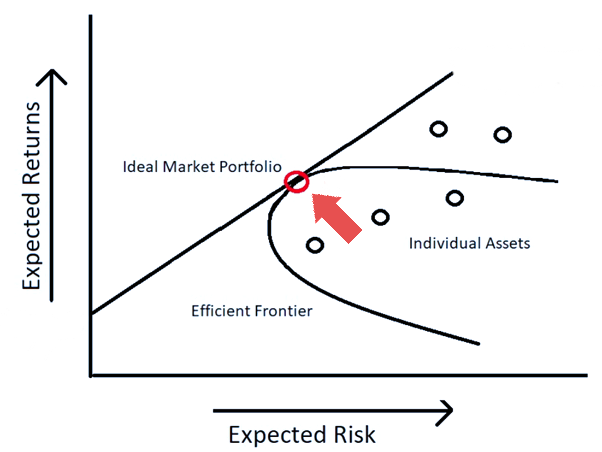

Why? Because diversification cuts overall risk and enhances returns – almost by magic. It’s the only ‘free lunch’ in investing.

To diversify at the asset-class level, owning both Property and Stocks mitigates asset-

And if you only owned stocks, instead of mainly owning individual company shares, it’s better to mainly own diversified index-tracking ETFs plus a sprinkling of your favourite shares.

Being properly diversified pushes your portfolio up and left to the “Ideal Market Portfolio”, as shown in the image below.

Doing this does not require deep technical knowledge. But if you enjoy geeking out on this stuff, read the theory here on the Capital Asset Pricing Model

A Diversified, Holy Grail Portfolio …

How Stocks and Property go together perfectly: Why I own both …

My stock portfolio grew by 22% in 2023 but my property values fell. In 2022, the opposite happened.

The combination of owning both smooths out my overall portfolio.

Differences: Apart from returns, other considerations are …

- Stocks have higher volatility but that means more liquidity

- Property is more hassle, but that means an ability to add value.

- Property is subject to tax, interest rate and government policy risks

Similarities

- Stock gains and dividends are tax-free in some wrappers, as is commercial property

- Recurring Income: Stocks and Options generate recurring income, like Property earning rent

- Both are beneficiaries of inflation and their values tend to outpace it

In Summary

When owning multiple asset classes in our portfolio, that mitigates asset-specific risks, creating a smoother return profile. At the same time, we enjoy the benefits of their similarities.

For more intel on creating a diversified asset-class portfolio, read this

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now