Warren Buffett says “The stockmarket is a device for transferring wealth from the impatient to the patient”.

It sounds strange but sell-offs enable positive returns. Without the occasional sell-off, everyone would invest all their money at once, meaning no marginal new buyers, meaning no upside. So don’t be afraid of sell-offs. When you embrace them, you increase your returns.

How? By drip-feeding your investments – taking advantage of Pound-Cost Averaging (PCA) to buy cheaper. Crystal balls not required.

In our Investment Academy we show you how to do PCA properly, step-by-step, in diversified ETFs and low-cost platforms – more on that further down with a special discount.

Cast your mind back to New Year’s Day, 2020. It was the birth of a brand new decade but we were blissfully unaware of the shocker that would turn our lives upside down for at least the next 2 years. On 1st January 2020, if you had undeployed cash sitting around, it might have felt like a good time to invest as things looked pretty stable.

But wait – imagine your crystal ball told you EXACTLY what was about to hit us, and the resulting market crash. Anyone with that information would have made a sharp U-turn back to the safety of their bank account that paid a seemingly heavenly 0.01%!

Crystal balls are commonplace in the world of investing, especially amongst doom merchants. There’s a joke in investment circles that doomsters have predicted 7 of the last 2 recessions! Having such fears often provide an excuse to do nothing, which unfortunately means an erosion of cash by that silent killer – inflation. Since the Covid sell-off global markets have risen by 72% with doomsters predicting an imminent collapse at every point since the lows.

So back to your crystal ball on 1st January 2020. Let’s imagine it gave you the actual date – March 23rd – when the market crash would eventually bottom out, providing your entry point into the markets.

Your choice would then be either: a) start investing your money on 1st Jan knowing about the imminent crash or b) wait until we reach the bottom on March 23rd before investing. Surely, the best result would have been to wait? Surprisingly not.

Crystal Ball vs Drip-feeding throughout (Pound-Cost Averaging)

Here’s the beauty of Pound-Cost Averaging (PCA) – it just works. In our Investment Academy classes we show you how to do PCA simply, properly, in a diversified way, via low-cost ETFs and platforms.

During our classes we compare drip-feeding your money into the markets vs waiting until the markets bottom out. It turns out that even with perfect prediction, you’d still be better off having drip-fed your money in – even when knowing the market was about to sell-off.

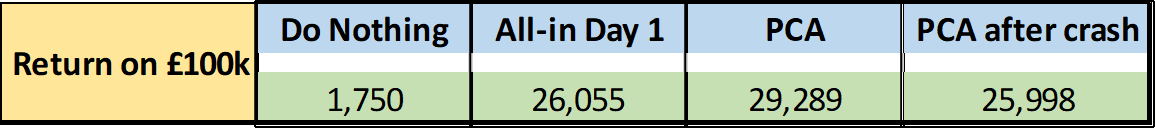

Using the Covid crash to illustrate – we start with £100k on 1st January 2020 and compare four options:

o Do nothing (sit in cash)

o Go all-in, on January 1st 2020

o Starting 1st Jan, drip-feed £10k monthly (knowing we were about to sell-off)

o Starting at the March 23rd low, drip-feed £10k monthly

We invested in a low-cost Globally diversified equity ETF. Below are the results:

Values of your original £100k investment …

The clear winner is to invest with PCA, as soon as you have the money – regardless of what the crystal ball tells us.

Why?

PCA allows you to invest irrespective of market moves. One should be happy:

– If markets sell-off: you get to buy shares on sale

– If markets rise: you’re benefiting from having money in the markets

– In all scenarios, you receive dividends anyway

In the case of the Covid crash in 2020, being invested prior to the crash allowed you to have greater exposure to the subsequent strong recovery. That compares to having minimal exposure if you waited to invest until the bottom. This allowed the earlier-entry PCA to perform better.

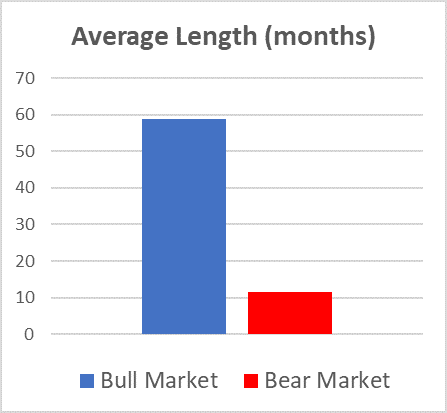

Another reason for PCA: Bull markets are long and drawn out, Bear markets are shorter and sharper.

Using 50+ years of market data, here’s how bull and bear markets compare in duration and returns. This makes it ideal to implement PCA …

PCA is an important part of my own strategy. It allows simple, stress-free, passive, inflation-beating, compounded growth.

On our Investment Academy we show you how to do PCA properly, step-by-step, in diversified ETFs and low-cost platforms. That’s in addition to learning about other low-cost ETFs, stock-picking analysis and Options trading to generate monthly cashflow income.

List of Modules we cover

Module 1: Core Investment Foundations – Asset Class Drill-down – Diversification;

Module 2: Your objectives Investment Plan: How to reach your goals

Module 3: Investment Platforms: which ones are cheap and suit you? Demo

Module 4: ETFs, Funds, Low-cost investing. Core + Satellite Balanced Portfolio Creation

Module 5: Screening for stocks – how to find High Yield, High Quality and Value Stocks

Module 6: Stocks and Company Analysis – Professional stock-selection techniques

Module 7: Crypto Investing

Module 8: Options: to generate monthly cashflow income

Bonus Module: Secured Loans DD – Selecting the right ones and identifying the red flags

+ Live weekly 2-hour Group Mentoring and Q&A for EVERY module