Headlines like the above are commonplace in both traditional and social media.

Commentators and “gurus” also try to create their own stories and predictions.

No wonder investors are often confused and uncertain. The reality of investing is far simpler, as this article will hopefully illustrate.

If we pay attention to headlines and stories we’d expect a blood-bath most times. As the saying goes, the doomsters have predicted 17 of the last 2 declines!

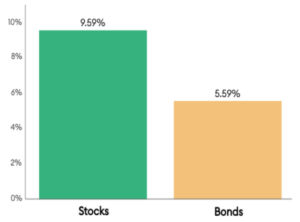

Now for the Reality – long term market returns …

Here’s the Key Point …

When we invest in global stocks, we DON’T buy stories.

We are buying a share of the profits in the greatest companies around the world. In return, we receive dividends, capital gains and compounded returns over the long term.

We achieve this via globally diversified ETFs and low-cost Funds – in wrappers that don’t incur tax on our dividends and capital gains.

Profits Growth = Growth in Stocks …

Buying stocks means we are buying a share of profits. Stocks see through headlines and stories – Instead, they react to profits growth. The good news: profits ALWAYS grow over time.

Be evidence-driven, not story-driven.

Below is a long term chart of US profits. It’s clear that profits keep growing over time – despite recessions, inflation, debt, wars and banking crises.

Occasionally, profits decline temporarily but they NEVER stay down because capitalism ensures companies prosper and profits grow over time. Some companies will die but the fittest survive and take over as leaders.

When we buy globally diversified ETFs we automatically own the survivors – i.e. the best companies around the world. Any company that dies away will cease to be included in the ETFs.

Company Profits since 1984 …

Profits Power Shares …

Ignore the headlines and scare stories. Profits are the ultimate driver of shares. As long as capitalism exists, profits have to keep growing and shares have to follow – over time.

This process has existed for longer than 150 years and nothing will change it … unless one believes in the end of capitalism. Then, we’d be worrying about far bigger issues than deciding how to invest our money …

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now