Mistake 1: Investing without knowing your objectives

It’s amazing how many people invest without first knowing what they want (or need) to achieve. It’s like getting in your car and driving off without a destination in mind! This must be the first thing you think about before even considering your choice of investment.

Two real examples illustrate this:

1) Andy is an IT manager working for a global firm. He earns £160k pa which is more than enough to cover his monthly outgoings. He wants to move to a bigger home but doesn’t currently have the capital required for the increased deposit, even though his income is sufficient to support the larger mortgage.

Looking at Andy’s investments, his savings were in interest-generating investments such as P2P loans and corporate bonds. When I asked why, Andy said the higher rates looked attractive.

But did he need those higher rates and the additional income? No, because his salary was more than sufficient. What he really needed was to generate capital gains to make that house move possible. Following this aha moment he restructured his portfolio towards capital gain, focusing more on property development and equities, to create the capital required for a new home.

2) Sima left the corporate world 2 years ago and was now fully focused on building a property portfolio. She had accumulated a large savings pot which would help to sustain her before the property business got off the ground. Although her savings pot was sizeable, it was being eroded due to a lack of regular income.

Looking at the composition of Sima’s portfolio, around 65% was in higher-risk capital generative investments such as private equity, start-up venture capital and emerging market equities. What Sima really needed right now was an income replacement strategy that would relieve pressure on her savings. She began to look at higher-yielding HMOs, bridging loans that paid 8% pa and other asset-backed debt investments. These investments provided two-thirds of Sima’s income requirements and allowed the use of her savings pot to grow her property portfolio rather than funding living expenses.

How the pros avoid Mistake 1: by starting with the end-objectives and working backwards:

1) Sit down and detail what you already have and what you actually need

2) Quantify the what and when – eg: £250k in 5 years or £5,000 pm income in 5 years. Or it might be a target for your children’s long-term future

3) This then tells you WHY you are investing

4) Now work backwards for HOW you will achieve your WHY. Then you are ready to make investments focused on getting you where you need

5) Investments might include property, development, equities, higher-yielding debt investments etc. The investment choice is large but your why dictates your need for capital growth, income, security, liquidity or some combination.

Mistake 2: Neglecting Due Diligence (DD)

Many investors neglect proper DD because they either don’t know where to start or they convince themselves it’s not necessary. Due Diligence is a critical part of any investment decision and avoiding it will be costly. Conversely, doing proper DD allows you to genuinely understand the most profitable opportunities versus ones that don’t stack up.

Look at it this way: If you don’t carry out proper independent DD, how can you be sure your capital will be returned? Oh, and that word independent was highlighted for good reason: many investors diligently read literature sent out by the company promoting the investment. Sadly, they mistake this for “due diligence” when, in fact, the literature is mainly just a sales document.

How the pros avoid Mistake 2 … by doing independent DD, outside of what the company has said. By all means read the supplied literature but only after your own DD.

At InvestLikeAPro our DD on property development projects includes:

1) DD on the developer, broken down into these areas:

* a) on the individual(s)

* b) on their approach to risk management

* c) on the wider team of professionals being used

2) on the security backing the investment and structure of the investment vehicle

3) on the project itself

How we do this is covered here in more detail

Mistake 3: Not reinvesting your interest/dividends

This one is a biggie! It’s all about the power of compounding which Einstein called the 8th wonder of the world. Your wealth will be magnified by reinvesting and compounding your returns.

A common mistake is to spend your investment income/dividends instead of reinvesting. This stops you from benefiting from compounding. An example using simple maths illustrates the power of compounding:

Say you have £50,000 to invest. Now let’s compare what happens to your capital in 4 different scenarios: a) you spend all your income, b) reinvest your income but don’t make further new investments, c) reinvest income and make further investments of £5k pa and d) reinvest income and make new investments of £20k pa to maximise your ISA allowance. The results are in the table below:

In scenario a): You spend all your income. Your capital constantly stays the same. Of course, the real value of your £50k, after inflation, is much reduced after several years.

In scenario b): By reinvesting your income, the magic of compounding starts to appear. Your capital doubles in 10 years.

Scenario c) becomes more interesting. Making regular annual investments of £5k, coupled with reinvestment, compounds your initial £50k into £167k after 10 years. It doubles after 5 years.

Scenario d) utilises your full annual ISA allowance. Here, your £50k doubles after only 2 years.

Simply reinvesting, instead of spending, the income in scenario b) results in nearly £50k of extra capital by year 10! Investing a further £5k per annum (scenario c) creates an additional £117k of capital in year 10.

These outcomes are fantastic, but actually the financial principles are very simple: reinvestment, regular new investment and compounding. The assumed 7% annual return is lower than the historical trend, and even in today’s low rate environment, you can get 8% in secured asset-backed investments.

How to avoid Mistake 3: Always reinvest your income. Moreover, maximise your additional regular investments as much as possible: pay yourself first, even before paying your bills (reference to Robert Kiyosaki’s book, Rich Dad, Poor Dad). Then let compounding work its magic!

Mistake 4: Jumping onto the latest bandwagon bubble

This one can be summarised by just one word: Bitcoin!

Bitcoin is a classic example of an investment bubble fuelled by hype and FOMO! At its peak of almost $20,000, i was receiving numerous emails per day on the subject. Many from senders that had no clue about investing, never mind the intricacies of currency systems or Blockchain technology. This gave me and my investors a strong indication to stay well clear. Nowadays, I see very few emails or publicity on the subject. As such, perhaps Bitcoin should be back on the radar!

Warren Buffet said to “be fearful when others are greedy and greedy when others are fearful”. This advice should should be followed, particularly for liquid assets like stocks, currencies or crypto-currencies.

How the pros avoid mistake 4: They don’t get swayed by hype and FOMO. Your email inbox can be a very good counter-indicator! As can be the number of course-sellers, newspaper articles, your grandmother or your taxi driver!

The best investment, over the long term, is to stick with dependable, income generating investments that compound over the long term. A solid asset-backed investment with first-charge security generating 8-10%pa could well end up being more profitable than a high-risk build-out with a projected 60% return. A boring but dependable stock might well perform better than the latest hot tip.

Mistake 5: Losing your wealth to fund manager fees & costs

Very few people realise just how much in fees are given away to fund managers – trust me, I used to be one! Some fees are clearly stated (annual management fees, OCF) whilst many others are harder to decipher – eg entry and exit costs, admin and custody fees, trading transaction costs, trading commissions etc.

Costs can amount to 2% pa as “leakage” from your funds. Often, much more. Imagine you have £100k invested which returns an average of 6% pa. Invested over 25 years, your capital would grow to £430k. In itself this highlights the power of compounding but more on that later. However, after paying away 2% pa in fees, compounded over the 25 years, you are left with only £260k with £170k eaten away in fees and costs. Investing through lower-cost passive funds/ETFs that leak approx 0.5% generates a vastly better result, as shown in the chart.

Passive funds (or ETFs) simply track the index (eg FTSE100) and can therefore charge lower fees. Active funds have significantly higher costs because they are supposed to outperform the index via active stock selection. However, the data shows that active funds fail to outperform so it follows that low-cost passive funds should be your only option.

Avoiding Mistake 5 … Having been an active fund manager and being aware of all the costs, I always advise investing via low cost tracker funds or ETFs. All the usual types are available: Equities, Bonds, Equity income, Emerging markets etc. The largest providers include Vanguard and iShares, with investment being possible through most investment platforms, including within an ISA.

Mistake 6: Losing your wealth to the taxman

Many investors do not invest in a tax-efficient manner. Your ISA allowance and pension are two obvious ways to invest in a tax-efficient way. Outside of such shelters you could be liable for income tax (up to 45% on interest and 38% on dividends) and capital gains tax (CGT) of up to 28%. Within property, there are other taxes including tax on received rents (previously, this was a tax on profits), corporation tax on development profits within a company or CGT on disposals. Your accountant or tax advisor can provide much more detailed advice on tax efficiency.

The easiest and most immediate tax-efficient investment is to fully utilise your ISA each year. Any investment made through an ISA will never pay income tax or CGT so it really is a no-brainer to max out your allowance. You can’t buy a property through an ISA but several crowdfunding platforms have ISAs that allow investment into property projects.

The limit on how much you can invest is currently £20,000 pa per person. So a couple can put £40,000 into an ISA and, if you have children, you can invest for them too.

Avoiding Mistake 6: First, maximise your annual allowance in ISAs. If you’ve done that already, seek professional tax/pensions advice on investing the rest in the most efficient way. Paying for tax advice is an investment in itself and will pay off many times over in the long run.

Mistake 7: Being influenced by the marketing and projected gains without assessing the downside risk

We’ve all been there … falling for the glossy marketing, media image and clever branding. I fell for the iPhone just like everyone else! But when it comes to making investments, you must exercise your independent objectivity.

One aspect of clever marketing is that it gives investors a false sense of security. The marketing makes us believe the investment only has upside. If there is a public image and expensive marketing, there couldn’t possibly be downside, right? Wrong.

How the pros avoid Mistake 7: They cut through the promoter’s messaging and assess downside risk for themselves. That includes the following:

- Detailed analysis of the advertised return projection. Breaking down the calculations and questioning each line of the analysis that resulted in the projected ROI

- Stress testing for a market correction (applies to property and financial markets)

- Triple checking the value of any security that is related to the investment. Don’t take the developers word for the valuation. Do your own analysis

- Ensuring multiple exit strategies exist so that capital will be returned without risk

Here is further detailed guidance on how to carry out these checks

Mistake 8: Not diversifying

Diversification is the first rule in finance. Done properly, it results in lower risk and better returns. In investing jargon this is known as the Efficient Frontier which produces lower risk for higher returns. This lower risk comes from having a balanced portfolio of investments.

The pro portfolio is balanced in terms of risk (lower risk as well as higher risk investments) and balanced in terms of categories – see below. You don’t need to be a pro to have a balanced and diversified portfolio. Anyone can, and should. Very few investors are properly diversified.

You might have too much of your wealth in regular buy-to-lets or HMOs for instance, or too much in equities or, even worse, too much in cash savings earning next to nothing. Be diversified in terms of asset class (property, equities, bonds) and then, within each asset class.

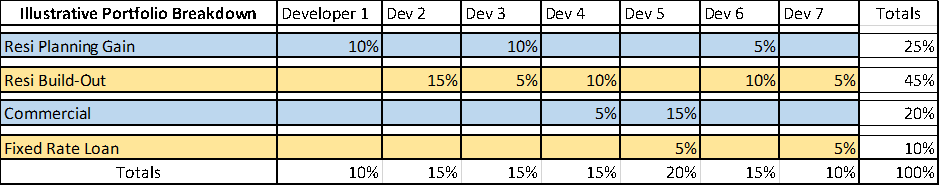

Within property it is sensible to have exposure to developments as well as owning property directly. A portfolio of (hands-off) investments in development projects, diversified across 8-10 different projects, can provide attractive returns. These projects can be diversified across the following categories:

- Geographical (eg avoid over-exposure to the London area)

- Sector (include residential, office, retail)

- Project type (pre-planning, build-outs)

- Exposure to a number of different developers, not just one or two

- Debt and Equity: have exposure to both debt and equity projects to balance your portfolio

How the pros avoid Mistake 8: At InvestLikeaPro, the portfolios we create (and share with other investors) are all properly diversified in the manner described here. An illustrative breakdown (for an investor’s portfolio) is shown below:

Mistake 9: Inadequate risk management and monitoring

Failing to monitor your investments is almost worse than failing to do the initial DD.

Why is monitoring important? Things change, markets move, and sh*t happens – which is what makes investment fascinating! However, you need to keep on top to avoid shocks that could be prevented. This is what risk management is all about. On the positive side, close monitoring helps you understand the key drivers of your investments and quickens your DD process for future investments.

How the pros avoid Mistake 9: Make monitoring a systematic process, seeking regular updates on the investments. You can have a spreadsheet with all your investments listed, containing all the relevant information such as dates, amount invested, projected returns, projected timeframes, key drivers such as GDV, costs etc.

At InvestLikeAPro we use monitors for our development portfolios. We break investments down into various KPIs for each aspect of the project and these KPIs are updated on a monthly basis. Below are some of the tools we use.

Portfolio Exposure Tool

Project KPI Updates

Mistake 10: Sitting in cash / failing to invest

History shows this to be a long-term mistake. There are always more excuses not to invest than reasons to invest. Very simply:

Not investing results in your cash losing value through inflation (which, by the way, is much higher than the official government number). On the other hand, investing your cash results in compounding over time that generates multiples of your original capital.

Here are the most common excuses for not investing:

- Not knowing where to start

- Not sure if this is the right time

- I need the cash for XYZ

- It’s too complicated

- Investing is too risky

- I’m already getting the “best rate” on the high street

- And many, many more …

All of these excuses just provide a false sense of security. Sadly, history shows that a failure to invest has consistently been a long-term mistake, whichever major asset class you look at. The only winners are the banks who get access to cheap cash from the millions who “save” with them.

Avoid Mistake 10 by joining the InvestLikeAPro Investor Circle for free. You’ll be the first to receive new investment insights and helpful ideas on how to build your capital and invest like a pro. All in a risk-managed and diversified manner.

Sign up at www.investlikeapro.co.uk

Manish Kataria CFA is a professional investor with 18 years’ experience in UK real estate and equity portfolio management. He has managed money for JPMorgan and other blue chip investment houses. Within real estate, he invests in and owns a range of UK property including developments, HMOs, serviced accommodation and BTLs.