When I first started to teach people how to compound and create financial security in diversified shares, around 25% of those interested were property investors.

Today, that number is around 80%. All seeking to passively diversify, grow their capital, and create recurring income in Options.

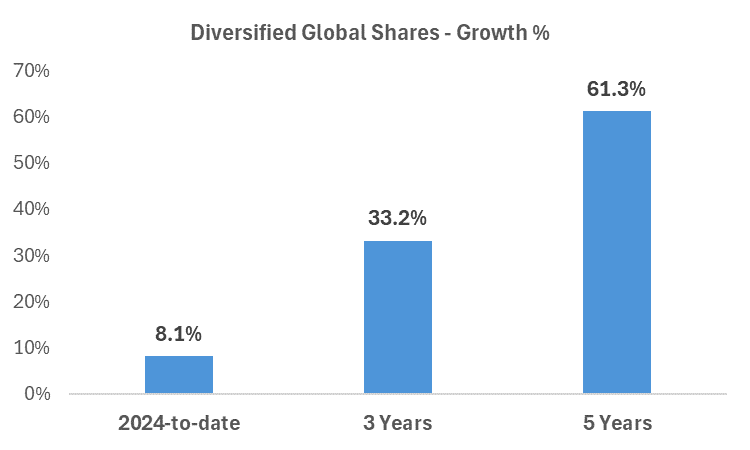

Has it been worth it to diversify?

It’s clear to see a diversified share portfolio more than beats inflation (it’s also passive, low-cost, and tax-free inside ISAs and Pensions) …

Learn How and Why …

Next week, on 5th June, I’m doing a live workshop showing WHY and HOW a diversified share portfolio should be a vital part of anyone’s passive portfolio.

When: Weds 5th June at 6pm

We’ll cover:

- ETFs & Funds – how to set-and-forget for proven inflation-beating growth

- How to compound your returns to enjoy passive financial security

- Neat tricks to minimise fees and legitimately avoid taxes on gains & income

- Effective diversification, alongside property, to mitigate potential policy risks from the upcoming election

- How to create new sources of recurring monthly income via options

- A live demo of how options earn monthly income

- The unbelievable simplicity in the setup of your passive portfolio

See you on Wednesday,

Manish

Ps Check out my new explainer video on Options … How Options are like Property: buy quality shares and rent them out for 1-3% per month

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now