The thought of inflation usually evokes anxieties about interest rates, higher cost of living, becoming worse-off or just general uncertainty. These are all valid concerns but in economics and investing, you can often find beneficiaries amongst all the uncertainty. Investors can turn pain into gain – as many on our Investment Academy programme have done already.

The original version of this article was published in the November 2021 edition of Property Investor News magazine.

As long as inflation doesn’t morph into hyper-inflation, the list of beneficiaries is plentiful. We’ll explore the list later but, first, it’s helpful to consider the reality of inflation data …

Three types of inflation to be aware of …

When thinking about the concept of inflation, I find it useful to subdivide it into three different variations.

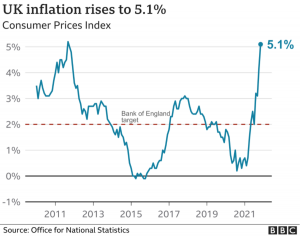

- The Official Rate. I label this as the “pretend rate” – i.e. what the government likes us to believe. Don’t believe it! The official rate (chart below, as of Nov ‘21) is unlikely to reflect anyone’s true rate of inflation. It’s also backward-looking: CPI measures year-on-year prices – i.e. comparing them to 12 months prior. So not only is it vastly under-egged, it uses old data.

- The Central Bank inflation rate. This is slightly more meaningful as it’s forward looking and, more important, impacts future interest rate decisions. Central Banks like the Bank of England forecast around 12-24 months out to model how inflation might evolve in the future. The Bank of England currently expects inflation to peak at around 5% before subsiding. Interestingly, the Bank’s Chief Economist Huw Pill, appears to disagree with his employer’s official forecast and believes the rate will peak higher. Investors need not panic about interest rates though. Central banks appear moderately relaxed – for now – about needing to materially raise rates (more on that later).

- The REALITY rate (for investors). As investors we are saving for the future – deferring today’s consumption for our future spending. As such, we should be concerned about the purchasing power of our money in the future. For this exercise to be meaningful we need to be aware of a TRUE measure of inflation. I have often argued this is much higher than the official rate – quite possibly at high single-digit levels, 7-10% perhaps.

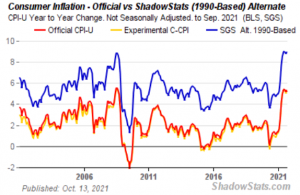

Don’t just take my word for it … ShadowStats is a US-based website run by veteran economist John Williams who has long campaigned against government manipulation of economic data. Williams maintains alternative measures of data such as money supply, unemployment, GDP and inflation. The chart below, from the website, shows how inflation would look today based on the calculation methodology used by the government in 1990. The thinking is that the government frequently changes the methodology to artificially supress the true level of inflation.

Using the 1990 measure, the rate in the US would be around 9% (the blue line in the chart below), much higher than the official level (the red line). Interestingly, if the 1980 calculation process had still been used the rate today would be even higher at 14%, according to the website. Although this particular data is US-centric, I’d say the same applies globally.

The upshot of this is that your cash erodes much faster than you might imagine, via the negative compounding of inflation. Using a more realistic inflation rate of 7.5%, an initial pot of £100k will lose £32k in real terms over 5 years and £54K over 10 years. That’s a significant loss of future purchasing power.

Holding cash can be helpful in certain situations such as enabling a quick property purchase. However, as demonstrated above, it’s damaging to hold too much cash for too long. Cash is the only major asset class guaranteed to lose real value on a daily basis, without fail. On the other hand, investing in real assets such as equities and property serves to protect your wealth against inflationary erosion. Over the long term, real assets have always kept up with the reality rate of inflation.

Inflation-Proofed investments

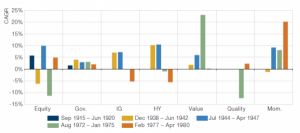

In a recent class within our investment academy programme, I compared various asset classes to evaluate their performance during previous inflationary periods. Certain asset classes are clear beneficiaries of inflation, based on their historical patterns.

When inflation remains moderately high the following asset classes are expected to outperform: Global Equities, Value Equities, Momentum Equities, Property, Infrastructure Assets, Commodities – but interestingly, not Gold.

Global Equities

Equities, overall, tend to be a great beneficiary of inflation because company revenues, profits and cashflows tend to grow in line with the reality rate of inflation. For some companies it’s even better because they have operational and financial leverage where costs are fixed whilst revenues can rise with inflation, resulting in a turbo-charging of profits. This goes a long way to explain why stockmarkets keep appreciating over time.

Let’s illustrate this point with some numbers. With inflation, companies can increase their profits via “operational leverage”. Using a simple example, let’s say a company had £100k in revenues and £80k in costs. That resulted in profits of £20k. Now, let’s assume 5% inflation across the board. As a result revenues rise to £105k and costs go up to £84k, resulting in a profit of £21k. That equates to a 5% increase in the company’s profits due to operational leverage. In reality it can work better because many company costs are generally fixed in the short-medium term – eg rents, staff, leases, contracts. So in reality, companies can enjoy an inflation-beating rise in profits.

All else being equal, as profits rise, share prices would also appreciate. Hence, equities tend to be a great hedge for inflation.

How to take advantage of this? There are many globally diversified equity ETFs out there. Vanguard, iShares and SPDR are effective providers of global equity ETFs. In our Investment Academy programme we go through a detailed list and performance comparison of relevant low-cost ETFs.

Value vs Growth equities

There are also different variations of global equities – called “equity factors”. The main factors being: Value, Growth, Momentum, Quality, Yield and Size. You can buy an ETF for each and any of these factors. As per the study in the chart below, the best performing factors during inflationary periods have been Value and Momentum equities.

Asset class performance during inflationary periods

Why do Value equities perform better? This relates to rising interest rates during an inflationary phase. Rising rates are less favourable for Growth companies eg Tech stocks, so they fall out of favour. As this happens investors rotate from Growth into Value shares. (A more technical analysis for why growth shares underperform during rising rates/yields is given at the bottom of this article)

How to take advantage? There are a number of Value-focused ETFs available. iShares is a good place to start.

Momentum Equities

Momentum describes any pattern that keeps building on itself. Momentum equities simply keep rising over a period of time. Momentum is not specifically connected with an inflationary period but because the latter has tended to persist for a period of time, that provided an environment for momentum-oriented stocks to keep moving in the same direction. How to take advantage? Again, there are a number of Momentum-focused ETFs out there. iShares is one provider of Momentum ETFs.

Property

Property is a leveraged asset class meaning it is sensitive to interest rates. Currently, central banks appear willing to let inflation run in the hope it is only reflecting transitory post-Covid adjustments. If central banks are correct, moderate inflation will not lead to significant interest rate hikes. That combination of low rates and moderate inflation (translating into moderate wage rises) is supportive for residential property – and indeed, other sectors such as commercial and industrial.

How to take advantage? Apart from buying property directly, in the usual way, we can invest in REITs (Real Estate Investment Trusts) which are essentially property portfolios traded on the stock exchange. There are REITs available in various different property sectors including Residential, Storage, Office, Retail and Industrial. Larger and more liquid REITs are the best place to start for new investors. A good place to begin looking is the website REIT Comparison.

There is a REIT section in our Investment Academy programme where we go through various REITs and compare them in terms of asset-type and performance.

Infrastructure Assets

These are assets such as toll roads, bridges, transportation, utilities, telecoms networks, wind farms etc. Usually, the owners/operators of these assets have a government-mandated contract to pass inflation onto end-users. Hence, the profits and values of these assets are inflation-proofed.

How to take advantage? You or I are unlikely to go out and buy a bridge or a wind farm but, luckily, there are Infrastructure ETFs available to us. iShares and SPDR are two good providers of such ETFs.

Commodities

Commodities have historically enjoyed a strong correlation with inflation, making them a useful inflation hedge – when inflation is accelerating up. “Commodities” is a broad category that covers oil, energy, metals and agriculture.

How to take advantage? Again, you wouldn’t pop out and buy a barrel of oil but there are diversified commodity ETFs available from providers such as iShares, L&G and Invesco.

What about Gold?

Gold as an inflation hedge is somewhat of a myth. Gold has failed to perform this role on many occasions with 2021 being a good example. After a long time 2021 saw official inflation data break out to print multi-year highs. Despite that, gold has made losses in 2021.

Generally, I remain sceptical because of gold’s lack of cashflow. Unlike equities, which have to keep up with profits and dividend growth, gold can “afford” not to make positive returns for long periods of time. Indeed, between 1982 and 2002, gold went sideways for 20 years (see chart below). Worse, adjusting for inflation, that equates to a significant loss in real terms. Without cashflow, gold can conceivably do the same again … or it can rocket up! It’s always difficult to call gold because it relies on numerous factors including the US dollar, liquidity and Asian demand.

Crypto

Perhaps this is the new digital gold? … Your guess will be as good as mine!

A caveat to all of the above is a scenario where inflation threatens to spiral out of control. Here, no asset class would be spared – that includes leveraged assets such as property and equities, as well as “safe” fixed-income securities such as government bonds. Thankfully, this scenario is not my base-case expectation.

In Summary, I remain positive on risk-assets such as equities and property over the long term. Many investors attending my investment programme have embraced the above investments by learning how to cost-effectively implement these strategies and successfully inflation-proof their capital with attractive returns.

Of course, investors should always be aware that capital is always at risk and past performance is no guarantee for the the future. Investors should also note that the above analysis is entirely my personal opinion and should not be taken as investment advice for your own circumstances which might be different.

To learn more about how to create your own inflation-proofed set-and-forget diversified compounding portfolio, click here to learn more.

A more technical explanation for the impact of rising rates/yields on growth equities ..

The following expands on the commentary above around growth v value equities

When growth and/or inflation moves unexpectedly higher, there will be resulting pressure for rising bond yields and interest rates. Growth equities (eg technology shares) have a higher percentage of their valuation weighted later in their economic life. Value equities (eg banks, energy, commodity companies) have a relatively larger amount of their valuation towards the earlier part of their life. When interest rates rise, that disproportionately affects the present day valuation of growth companies as the discounting process in a discounted cashflow (DCF) penalises higher growth companies more when rates are rising. When this happens, you often see a rotation of money from growth towards value shares.

For those wishing to learn more about this, visit Discounted Cash Flow (DCF) Definition (investopedia.com)