It never ceases to amaze me how enthusiastic Martin Lewis (MoneySavingExpert guy) gets about saving 50p at Greggs … or the latest bargain at Lidl.

Don’t get me wrong, I like Lidl (keep that to yourself) but there are far bigger, life-changing deals available.

Like the incredible deals we get from HMRC (of all people!) – namely, our ISA and Pension allowances which are worth £ tens, if not hundreds of thousands of pounds.

This is where the true wealth creation is.

3 types of ISAs

Many people believe an ISA is only a savings account. That’s a Cash ISA – something Martin Lewis might bang on about.

There are two other ISAs available that are worth considering:

- Stocks and Shares ISA: Returned 8-10% on average historically, invested in globally diversified shares

- IF-ISA: Returning between 5-15%, typically investing in peer-to-peer loans

A common myth about Stocks & Shares ISAs is to believe they are risky. So, the majority of people save in a Cash ISA instead, which is almost guaranteed to lose money vs inflation. This is the safety illusion of cash!

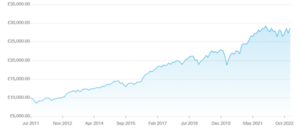

A core ISA/Pension investment made by attendees of our Investment Academy is charted below. This is one of the Global Equity ETFs covered in Module 2 of the programme. You can see how un-risky it has been: returning +10.1% pa on average, in the last 10 years …

Stocks & Shares ISAs: NOT risky when done properly …

Wealth creation is not just about making returns. KEEPING those returns by minimising fees and taxes can sometimes contribute even more to your final compounded wealth. ISAs and Pensions help you keep your returns instead of paying them to the taxman.

My advice to investors: fill as much of your ISA or Pension allowance as you possibly can. If you don’t USE it, you will LOSE it forever.

More people becoming ISA Millionaires …

A Stocks and Shares ISA can fluctuate in value but has never made a permanent loss. Every decline has always been temporary and proceeded to make gains averaging 8-10% pa on average. That’s what shares do – see my favourite chart below.

HMRC allows you to invest up to £20k pa in an ISA. Which of the 3 types of ISA you choose is up to you but one thing is common: your gains and income are tax-free forever …

a big reason why more people are becoming ISA millionaires.

Pensions: Buy Shares at a 40% Discount: use your Pension Allowance

HMRC gifts up to 40% on our pension contributions. That means if you contribute £10,000 the net cost to you is only £6,000. £4,000 is your free gift from HMRC. Company owners get a discount of up to 25%.

Put differently, even if the market crashes by 40% (an extremely rare event), you would not lose: £10k invested becomes £6k which was your original cost.

An even more generous gift …

From 6th April 2023 – the annual contribution limit is increased to £60k and the overall limit disappears. Which means your pension pot can grow tax-free without limits!

This is HUGE. It lets you build tax-free compounded wealth for your future security.

Don’t Miss the Deadline

Annual allowances for both ISAs and Pensions run to April 5th. Use it or lose it forever!

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now