Most people think the outcome from investing is only related to the ups and downs in the market.

Of course there’s a relationship (just as well, because markets tend to rise 7-8 times out of 10) – but there are many ways to invest without worrying about market movements.

Everyone is different so we can easily customise our investments depending on our risk profile or age, income requirements, need for capital growth, or personal liquidity needs.

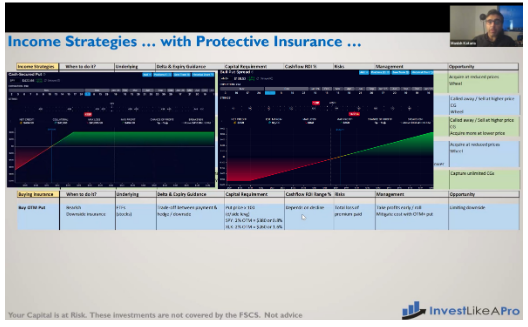

As an example, in our Options classes, attendees learn how to earn monthly income and own insurance to protect any downside, if needed (see screenshot below).

Here are some other ways to invest according to your own risk profile or personal requirements:

- Achieve more stable returns through low-risk, set-and-forget balanced funds

- Owning Bonds can (usually) balance out stocks. In a recession, bonds serve as a hedge vs stocks. Again, you can do this with simple, set-and-forget ETFs and funds

- If you need income, you can create recurring streams of cashflow through Options, Dividends and REITs

- If you seek capital growth, you can own high growth stocks and ETFs in the Tech and Ai sectors, for example

- If feeling cautious and fearing a decline, you can buy protective insurance hedges (as per the screenshot below from our options class)

Options Class – demonstrating Insurance hedges …

Shown above is a Bull Put Spread which involves selling a put option for income earning around 1-3% per month plus buying another put option for insurance purposes.

Investing is rewarding but also flexible enough to achieve from it what you personally need.

And it’s all a lot easier than you might imagine. Nowadays, there are innovative ETFs and tools that allow what the pros already do – at a fraction of the cost and with super simplicity.

Key Messages from this article

- Investing is not just about “up or down”

- You can easily customise your portfolio to suit your age, risk profile, income needs, etc

- Nowadays, this can be very easy to do and you don’t need to pay excessive fees to do so

- You can purchase “insurance hedges” to protect against any temporary declines

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now