Uncertainty is a known unknown. This is true of health, relationships, life in general, investing, and global events such as conflicts.

First and foremost, it goes without saying that a discussion about markets is secondary to the loss of life during such conflicts.

That said, we should also be mindful of how widely-held beliefs and the media (incl social media) might distort our thinking about the impact of conflicts on markets.

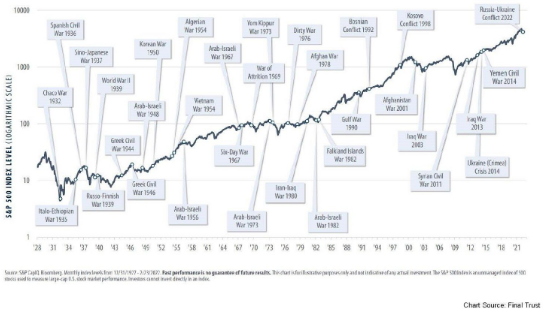

In reality, wars and conflicts tend to have a fairly benign impact on markets (see chart below). Historically, on average, they resulted in a 5.1% decline which took an average of 47 days to fully recover back to previous levels.

Historical Conflicts and Market Performance

The chart below tracks the market and major conflicts over the last 100 years (the chart is for the S&P 500 index but the same applies across any index).

The labels on the chart may be a little small – but the important observation is the market always comes through conflicts of any type to bounce back and reach new highs.

Sadly, wars and conflicts are the norm. Market recoveries are also the norm – some significant examples below:

World War 2

The market declined until 1942 and rallied strongly thereafter despite the remaining years of war. The market ended the war higher than where is started.

9/11 Attacks

The market sold off nearly 12% in a short space of time but then recovered that loss within 15 trading days.

2003 Iraq War

The market declined by 5.3% before recovering all of that in 16 trading days.

Russia / Ukraine (2022)

Not straightforward because the market had already been impacted by rising inflation and interest rates prior to Russia’s invasion. But whilst the conflict continues, the markets have rebounded smartly during 2023-to date.

Zooming Out

The chart above showed the big trend – i.e. the market has historically shrugged off conflicts to rebound to new highs. Same for any other event, pandemics, recessions etc.

It’s clear to see: historical events have always been an opportunity to acquire stocks through diversified means – i.e. buying the best companies around the world.

During such times, Pound-cost-Averaging has always been your friend.

Key Messages from this email:

- Separate reality and observed evidence from widely held beliefs / media messaging

- Sadly, uncertainty and conflict is the norm

- … that doesn’t translate into permanent declines

- Pound-Cost-Averaging enables you to acquire quality assets during sell-offs

Time in the Markets always beats timing the markets

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now