December 06, 2025

A Surprise Performer in 2026 ? …

+ Investment Mastermind Video

Written by a human (me), not Ai.

Here’s a dark horse with the potential to surprise investors in 2026.

Specific ideas like this are usually first discussed amongst our investment circle community.

But I’m always happy to share more widely, as I did with these great performers this year:

- Gold

- Looking beyond the S&P500 to invest smarter

- Israel’s strong market performance

Btw: For more insights like this – straight to your inbox – leave your details in the box at top of this page ☝🏼

Today, I’m introducing Japan as the dark horse that might surprise investors in 2026.

To be clear, we have already been highlighting Japan and Asia inside our private community this year. As a way to diversify against the US. It’s worked well – with our favoured pan-Asian ETF returning 21% so far in 2025.

Japan holds a special place in my heart. I spent a good part of my professional investment career working there, analysing the market, and learning the language.

As investors, we had continuously high hopes for Japan to restructure and reform. And we were constantly disappointed!

But now … 2026 might become a pivotal year for Japan.

Because if/when Japan seriously starts to reform, its stockmarket will rocket to anticipate huge potential in growth and productivity.

Before explaining why Japan might surprise in 2026 (and how to invest in it), I need to stress this:

To be clear: Your financial independence won’t be determined by whether Japan outperforms in 2026.

Our passive Core GPI portfolio does the heavy lifting (with or without Japan).

More importantly: our lasting wealth depends on these 3 important things:

- A properly diversified Core portfolio (Set-and Forget)

- Including 3 essential ingredients in your portfolio: Growth, Protection, and Income – our GPI Portfolio gives you all 3

- Avoid leaking your wealth to Fees, Inflation and Taxes

In other words: Sustainable wealth is built by how we invest. Not by what we invest in.

And Now … 5 Reasons Japan Might Surprise Investors in 2026

1. A new pro-reform Prime Minister

Japan has just elected its first female Prime Minister – Sanae Takaichi – who is:

- A mentee of a previous reform-minded Prime Minister, Shinzo Abe. Fun fact: she is known to get by on 2-4 hours sleep – like her political hero Margaret Thatcher

- Pro-Growth. She wants to accelerate reforms and boost fiscal spending. The budget will be announced in early 2026 and that could be a catalyst for the stockmarket if it is market friendly

- She is committed to accelerating corporate reform measures

This combination: Reform + Stimulus … is exactly the kind of policy mix markets love – when it happens.

2. Is corporate reform finally happening?

For decades, Japanese companies hoarded cash and neglected shareholders. That may now be changing (although the pace of change may be slow). Japan is ripe for reform.

Japanese companies were known to prioritise their employees, above all else. So when I visited Japanese company management with my firm, it was clear that us shareholders were just an annoyance.

And Now, the corporate regulator is pressuring firms to:

- Increase shareholder returns

- Buy back shares

- Improve ROE and capital efficiency.

(ROE measures how efficiently a company is using its assets. And that determines stock valuations. Japan’s current ROE averages less than 10%, vs more than 20% in the US).

Prime Minister Takaichi wants to strengthen this trend.

This is a structural shift, not a short-term thing.

3. Share buybacks are increasing

Japanese companies are now buying back shares at the highest pace in history. Modelling US companies.

That supports stocks, improves earnings per share, and signals a major cultural shift in corporate behaviour.

4. Japan Benefits from Ai and Tech

Japan has some of the world’s most advanced tech companies.

It’s regaining global relevance in semiconductors, robotics, automation, and advanced manufacturing. Which plays directly into Japan’s historical strengths.

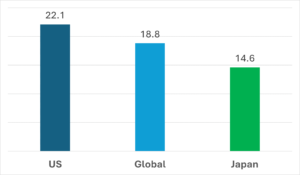

5. Attractive Valuations vs the US

Despite performing strongly this year, Japanese companies still trade at lower valuations globally, particularly vs the US.

Forward P/E Valuation Comparison …

What this means:

Japanese stocks are priced at a decent discount. That discount gives Japan the potential for outsized upside IF the reforms and earnings come through.

How do you invest in Japan?

- The easiest way is to buy a low-cost ETF or index fund. It can be owned tax-free inside an ISA or Pension

- You can find ETFs or Funds in your platform where you have your ISA, SIPP or SSAS

- A great way to own Japan is via Options (with EWJ ETF). You can get upside and earn approx 1.4% income per month. Learn how to do that here

And for Balance: The Risks …

No investment is without risk. Here are the main ones for Japan:

- Demographics: Japan has the most ageing population in the world, which has curtailed economic growth

- Debt: Government debt is high, at 200% of GDP. Although it’s mainly domestically funded, bond yields have recently risen in concern for the new PM’s ambitious fiscal spending plans

- Currency moves: Yen moves can impact gains or losses for UK investors

- Global slowdown: Japan is sensitive to global trade and recession possibilities

- And the BIG One: The hoped-for reforms could disappoint again.

Which is exactly why Japan is a Satellite, not a Core.

Want More Investment Ideas?

Want to see more ideas like Japan, Gold, non-US markets and income strategies like options?

And implement them properly – using our Copy and Paste method with us making sure you do it properly.

Join our Investment Academy and become part of our Investor Community.

We start live classes in January but you can join now for actionable investment content to get you started now.

For Accelerated and Personalised guidance to create your portfolio in the correct way – LIVE with me and our coaches making sure you’re doing it properly – Sign Up Now

You can Book a Call with me to ask any questions.

Rodcast Investment Mastermind

See me discuss the case for Japan in the Rodcast Investment Mastermind with Rod Turner and Adam Lawrence who also had their own cracking picks: A Uranium ETF and Google (Alphabet) shares.

Here’s the Video.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now