2023 was supposed to have been a bad year …

The narrative consistently scared people off investing (as it always does).

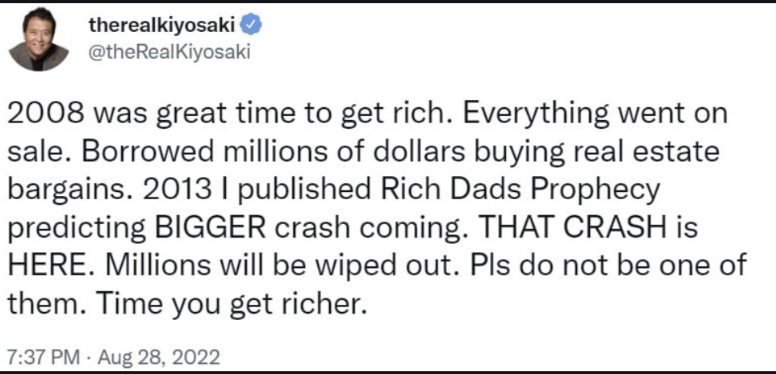

Robert Kiyosaki, author of Rich Dad, Poor Dad, is one of the chief scaremongers. Remember, he has predicted 17 of the last 2 crashes!

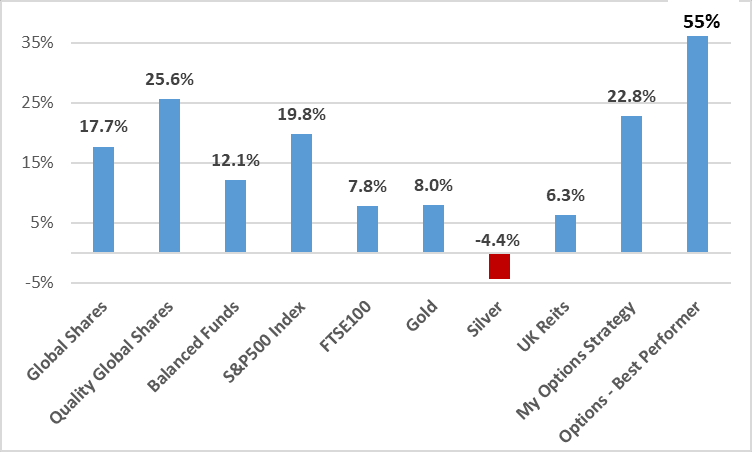

Now the reality: Here’s what actually happened in 2023 …

Tech/Ai shares (which we flagged early on) were even better performers.

Options Income did predictably well. Many of my past students had a strong year – with one generating 55%.

(Before rushing out to buy the S&P500 index or Tech Stocks – be careful of ‘recency bias‘. As flagged to past attendees, 2024 could see rotation into specific markets and sectors that underperformed in 2023).

Don’t forget, these returns came in a “bad” year which had:

- The highest inflation for 40 years

- The highest interest rates for 15 years

- Recession fears

- 2 major global conflicts: Russia/Ukraine and Israel/Gaza

Robert Kiyosaki kept messaging – like this tweet below which is typical of how he gets publicity! Btw, the market rose 22% since this tweet

2 things commentators don’t understand:

#1. Shares are driven by one thing only: Company Profits. You buy the best companies around the world, which have one objective: to maximise profits.

Companies exist for shareholders: you and I.

The reality is that company profits continuously grow – as reflected in the growth of stockmarkets over time.

Commentators don’t get this. Worse, they trade the newsflow – i.e. point 2 …

#2. They try market-timing (trading). Consistently missing the gains. Even worse, they recommend useless things like stop-losses.

A stop-loss is like asking your estate agent to automatically sell one of your properties when it dips by 5 or 10%.

Serious investors, like Warren Buffett, know that stop-losses often force you to sell at precisely the wrong time

Graduates of the Investment Academy don’t make these mistakes (but earn the returns instead) …

My in-person Investment Workshop is sold out (pls don’t try to book).

But, the new 6-week online Investment Academy starts soon and is better than ever …

Investment Academy – Starts 15th January

Step-by-Step LIVE training to create your Diversified, Low-Cost, Inflation-Beating, Growth and Income Portfolio with ETFs and Options

Popular with property and business owners seeking to diversify income and wealth with hassle-free growth and low-tax income. For SSAS, SIPP, ISA & Cash investors

More info here – Secure Your Place Now

Click above for more info + feedback from past attendees.

Get a special Bonus Package before it expires (see below)

Book a 15-min call to learn if the programme is right for you.

Investment Academy – Pro-Grade Content includes:

- Low-cost ETFs and funds – selecting using Pro-tools

- Platform selection and DD for Pensions and ISAs

- Options-investing to create a regular income stream

- Pro-grade Company and Stock analysis

- High-dividend stock selection – including REITs

- Tax-efficient investing via SSAS, SIPPs, ISAs

- Fee-efficient investing – save £,000s every single year

- Due Diligence on Loan opportunities

- Lifetime ongoing support in private Facebook group

Limited Time – Bonus Package

For a limited time only – in addition to the transformative Investment Academy:

- Private 1-1 Mentoring session with myself – to help with any area (Value £1,200)

- Three-month membership to our Live Investor Circle Masterminds with myself and previous attendees (value £717)

- Lifetime Support in private Facebook Group (£ priceless)

Total Bonus Package Value: £1,917. Limited-time offer.

Starts: Mon 15th Jan – for 6 weeks

Format: Weekly online live classes at 6pm (All classes recorded for catch-up if you miss any)

Plus, structured online training in between live classes.

If you have any questions, book a 15-min call to learn if the programme is right for you.

“If you don’t find a way to make money while you sleep, you might work until you die” … Warren Buffett

FAQs on the Investment Academy …

– I’ll be away for some of the course – will classes be recorded for catch-up?

Every live class and module is recorded and can be accessed anytime for easy catch-up.

– Can my SSAS pay for the training? (Or Ltd Company)

Yes. Many attendees in our previous programme had the cost paid for by their SSAS. The easiest thing is to initially pay using your own credit card and then provide a Recharge Invoice to your SSAS administrator who can arrange for the SSAS to reimburse you (we will provide you a Recharge Invoice template). Alternatively, many attendees have paid via their Ltd company.

– After completing the programme what ongoing support is there?

We have a private Facebook group for past and present attendees only. This is an active group where you can ask for guidance on any of the training elements or other investment related issues.

You also qualify for a 1-1 private coaching session on any topic(s) as pert of the bonus package (shown above)

– Is there other content apart from financial markets?

We have an entire module on property-related loans and P2P platforms – how to select safer opportunities by using our due diligence framework and avoiding the red flags (more info in the email copied below)

– Can I ask questions before booking?

Yes of course. If you have any questions, book a 15-min call to learn if the programme is right for you.

Investment Academy Programme – What You’ll Learn …

Starts: Mon 15th Jan – for 6 weeks

Format: Online Live classes (All classes recorded for catch-up if you miss any)

What you’ll learn on the Investment Academy

- How to correctly invest in: Shares, ETFs, Funds, Options … passively and with low complexity and maintenance

- How to minimise fees in low-cost ETFs

- How to select the best, cost-efficient Platforms

- My Option Strategy and process used for passive income

- Selecting higher dividend-yielding stocks

- How to shelter your gains and dividends via tax-efficient wrappers such as ISAs, SIPPs and SSAS

- The inside track on how the pros generate returns and, more importantly, what they never do

- Investors come away fully equipped with professional-grade tools and techniques to identify shares and ETFs with the best returns v risk

- Bonus Module: Due Diligence on Secured Loans – Selecting SECURE deals, identifying red flags

- Learn strategies that benefit from incredible compounding to secure your long-term financial future

- Discover ways to protect your portfolio from inflation – and beat it

- Live demos on finding the right ETFs, Funds, Shares and Options

- Understand how to identify and minimise hidden fees in funds and platforms

- You’ll come away a confident investor without ever needing a financial advisor – hence saving yourself £ thousands in unnecessary fees

- The programme provides all the knowledge and tools you’ll need for a lifetime of successful investing – exactly replicating the strategies used by Manish himself.

- The full programme is delivered by professional fund manager, Manish Kataria

- Full live support for your strategy throughout the programme

- Access to private Facebook group with lifetime support beyond the 6 weeks

Limited Places – Secure Your Place Now

If you have any questions, book a 15-min call to learn if the programme is right for you.

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Think Long-term and beat inflation

- Minimise those leakages

- Passive beats Active

- Stay educated to outperform 99% of the population …

- Investing this way is the key to achieving passive financial freedom

Last but not least …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now

Always Remember:

- Time in the Markets always beats timing the markets

- Stay Diversified

- Minimise those leakages: Fees, Inflation, and Taxes

- Financial Markets are a great source of recurring income

- ETFs, Balanced Funds and Options achieve all the above

- Being educated helps you outperform 99% of the population

… to ensure your investments work for YOUR financial freedom (not someone else’s)

And …

For more guidance, our Investment Academy will help you implement all of this in a step-by-step way.

Thousands of people have learnt how to diversify and pound-cost-average into low-cost, set-and-forget ETFs & Funds for inflation-beating growth. And Options to create recurring income.

Click here to learn about our Investment Academy

Finally …

– Don’t take the above as advice as it may not apply to you personally

– Your Capital is at Risk

– You may not be covered by the FSCS

– Anything mentioned in a podcast or in a previous article was valid at that time and may not continue to be now